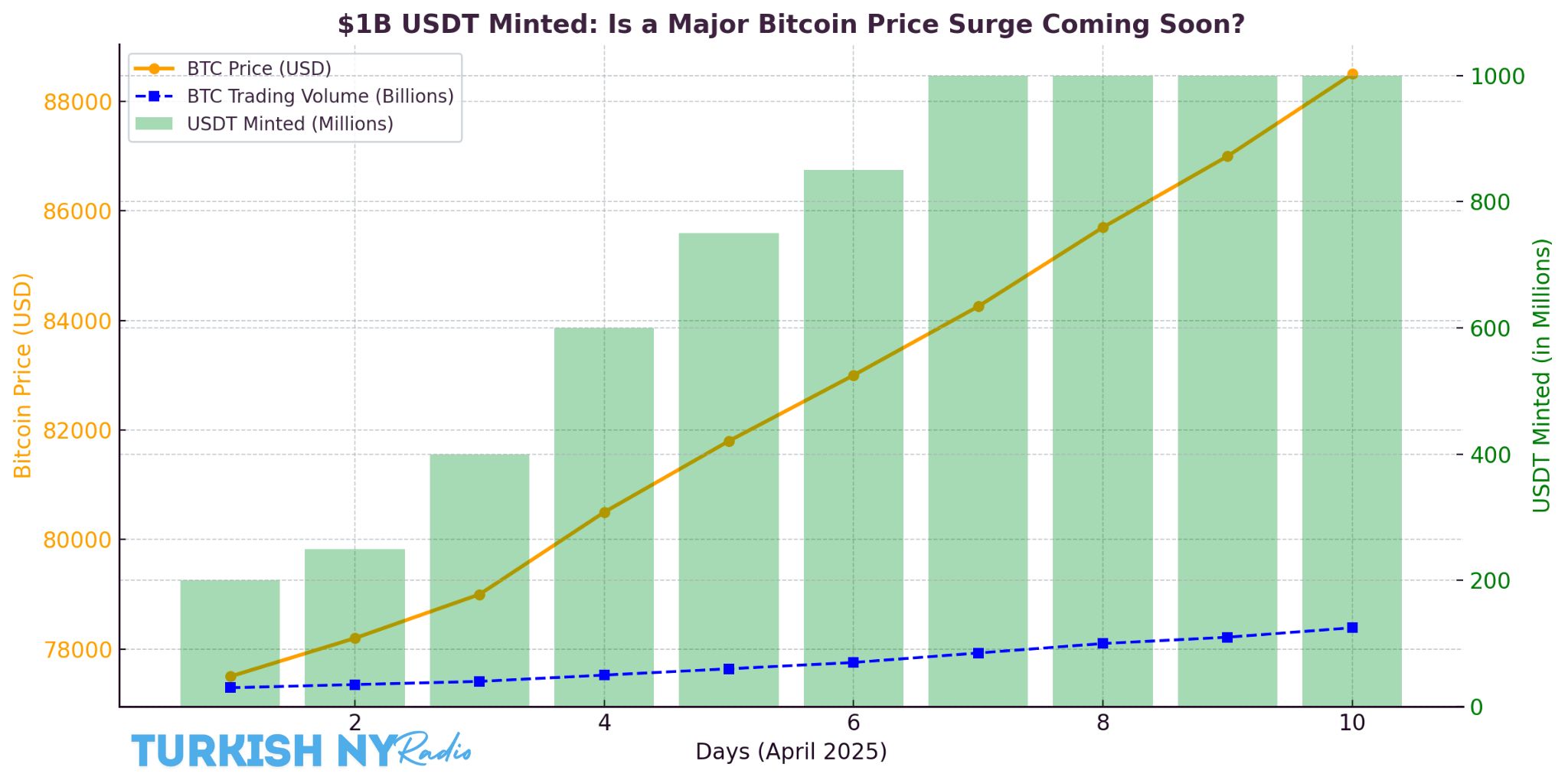

Tether (USDT) recently minted over $1 billion on the Tron network, indicating the possibility of strong demand from institutional investors or major crypto exchanges. The mint is in line with Tether’s strategy to provide for upcoming issuance needs and enable chain swaps throughout the networks, CEO Paolo Ardoino said. Shifting gears, it is worth noting that large-scale (787.1M) USDT minting is usually followed by increased trading or market accumulation. Tether’s market dominance means these events often move in the same direction as the broader crypto market.

Bitcoin Attempts to Break Through Resistance: A Technical Analysis

A key technical signal for upward price momentum is the bullish inverted head-and-shoulders pattern, which Bitcoin (BTC) recently broke out from on the hourly chart. If BTC manages to keep its hourly close above $84,000, analysts believe that the next point of interest is at the resistance at $88,500. This formation is a well-known reversal indicator in technical analysis, affirming the positive outlook. Currently, BTC is still trading at such important levels that it can sway short-term trader sentiment.

Bitcoin Price and Market Overview

Bitcoin (BTC)—April 2, 2025 As of this writing, Bitcoin is trading for around $84,257.00, with a small percentage increase in the past 24 hours. This small uptick shows some renewed optimism from within the trading crowd after recent bullish technical signals and market developments. Factors including Tether’s $1 billion USDT mint and strong institutional interest have historically preceded price uptrends. BTC holds above support with improving market sentiment.

Accumulation by Institutions at Market Dips

Tether has cunningly purchased 8,888 BTC for about $735 million in Q1 2025 at a time when Bitcoin was down more than 18%, indicating long-term value belief. This tactic mirrors an increasing institutional strategy of stocking up on Bitcoin during market lows. Our strategy has been followed by big players such as MicroStrategy and BlackRock, solidifying the view that, during times of volatility, Bitcoin is increasingly acting as a “flight-to-quality” asset. Such acquisitions reaffirm institutional confidence in Bitcoin’s resilience and its function as a hedge in uncertain markets.

Market Sentiment and Trading Activity

After the minting of $1 billion USDT and Bitcoin exceeding the bullish key technical pattern, there was a very large amount of trading. According to data provided by Coinglass, traders have opened long positions worth approximately $989 million and short positions worth $287 million in the $81,800 to $84,355 range. We can see that the derivatives market has been dominated by bullish sentiment in the past. In particular, the spurt in trading volume indicates renewed faith from investors — especially in terms of short-term momentum for the leading cryptocurrency. Broader crypto markets have reflected this optimism, suggesting that speculative interest is growing.

Read the latest price predictions and analyst insights:

Bitcoin Price Trajectory Psychics Are Positive Nic Puckrin, CEO of Coin Bureau, envisions a 360% rally for Bitcoin, repeating its spectacular 2017 breakout. If so, BTC may hit $150k by the close of 2025. This is backed by strong institutional demand, higher stablecoin activities, and halving cycle trends where past cycles mostly triggered big rallies. Such predictions further cement Bitcoin’s position as a long-term investment asset.

Conclusion

Tether’s new $1 billion USDT minting articulated technical patterns, and TK supported Bitcoin’s positive momentum for continued accumulation from major institutions. These elements combined indicate increasing investor confidence in Bitcoin’s potential moving, particularly as it closes in on crucial resistance levels. Further validation of Bitcoin’s long-term appeal during market corrections is institutional moves from firms such as Tether, MicroStrategy, and BlackRock. But cryptocurrency investments involve a high degree of risk. You should do thorough research and consult with qualified financial professionals before making any investment decisions.

Keep following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQS

1. Why does Tether minting one billion USDT matter for Bitcoin?

This whisper demand increases more from institutions or exchanges, which creates liquidity support and confidence for Bitcoin price upticks.

2. Is Bitcoin’s price really going to hit $88,500 anytime soon?

If BTC stays above $84,000 and volume maintains high levels, technical patterns hint that a possible move may occur towards near-term resistance at $88,500.

3. Who is buying Bitcoin in this dip?

Entities such as Tether, BlackRock, and MicroStrategy have used the latest dips to buy into Bitcoin, demonstrating a strong belief in long-term value.

4. What risk factors do I need to watch out for before I buy?

Cryptocurrencies are extremely volatile. Always do extensive research, follow technical trends, and have discussions with financial experts before performing any form of investment.

Glossary of Key Terms

1. USDT (Tether)

USDT: A stablecoin tied to the US dollar, USDT serves as a means to provide liquidity and stability in crypto markets. It is frequently minted in large amounts by Tether to accommodate demand on exchanges.

2. Bitcoin (BTC)

The first and most valuable cryptocurrency in the world by market cap. As a globally adopted digital store of value and speculative asset, BTC is utilized across crypto financial markets.

3. Minting (USDT Minting)

A project or platform issues new tokens. In this example, Tether created 1B USDT which can sometimes indicate an anticipation of inflows from institutions or chain swaps.

4. Resistance Level

A level at which selling pressure in an asset occurs based on historical price data, often preventing its run-ups. The next resistance for Bitcoin is around $88,500, Pruett says.

5. Institutional Investment

Massive asset purchases from financial institutions, like BlackRock or MicroStrategy. A sign of maturity and confidence in Bitcoin is often their entry into the space as well.

6. Long/Short Positions

If a long position is profitable when prices rise, a short position is profitable when prices fall. Article notes $989M in long BTC positioning, a bullish stance

7. Trading Volume

The overall volume traded of an asset over a time period They are confirming strong market momentum, such in the case of the Bitcoin breakout or USDT mint.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)