A CFTC-regulated platform, Coinbase Derivatives, LLC, is launching 24/7 spot Bitcoin and Ethereum perpetual futures trading in the U.S. It’s a landmark moment, as U.S. traders for the very first time will gain access to perpetual futures, or contracts without expiration dates.

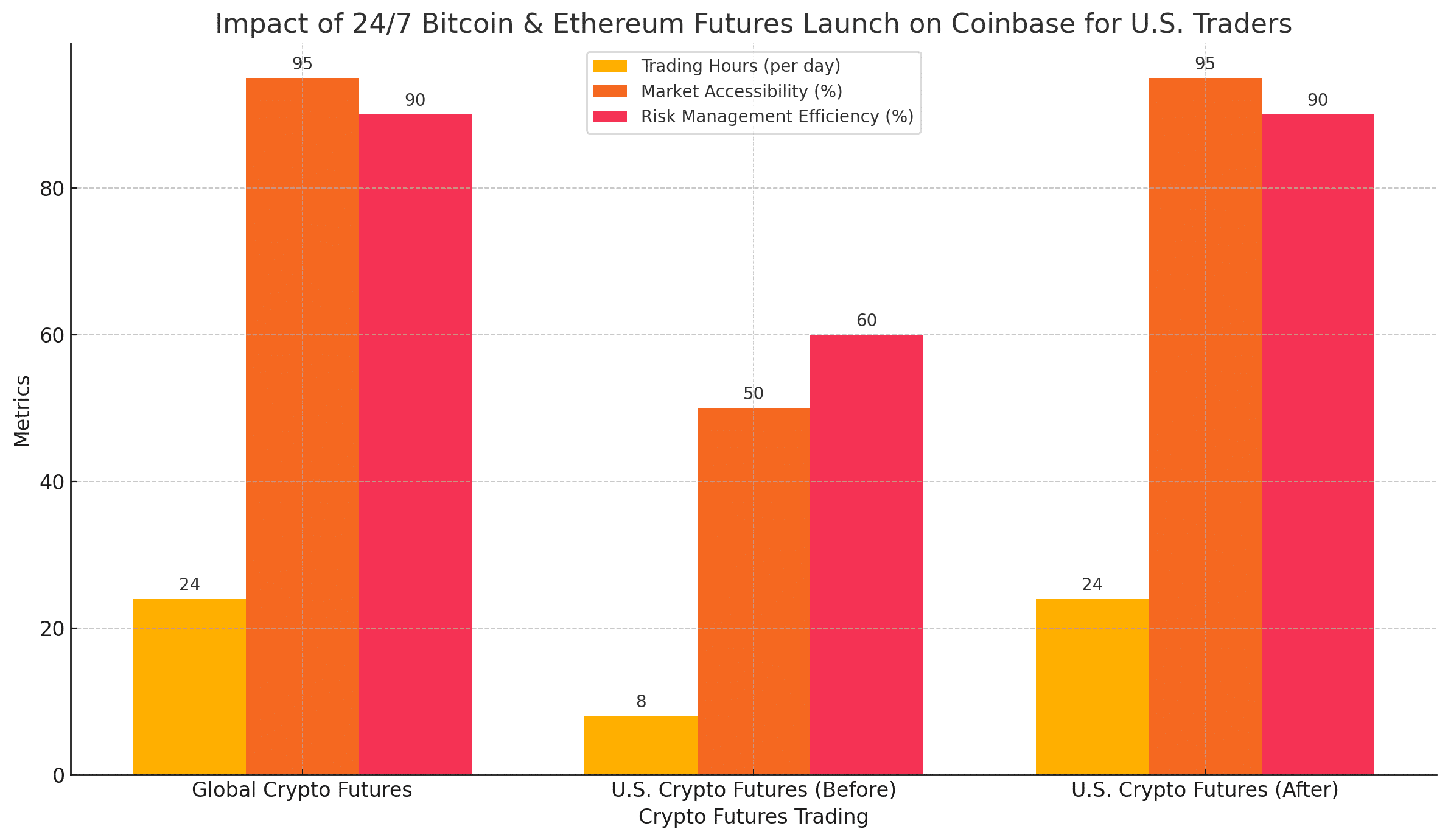

The move brings U.S. crypto derivatives markets in line with recognized international standards that enable both institutional and retail investors to have much greater flexibility—and better management of risk. As crypto derivatives currently represent over 75% of global trading volume, this represents a key step towards improving efficiency and competitiveness in the market domestically.

How Futures Trading Between 9:30 EDT and 16:00 EDT Helps U.S. Investors Bridge the Gap

Historically, U.S. derivatives markets have been confined to daily trading hours, limiting investors from reacting to global market moves in real-time. By allowing futures trading to occur on a 24/7 basis, Coinbase is breaking this limitation and paving the way for institutional and retail traders alike to manage risk and implement strategies when opportunities arise—regardless of time or day. The ability to enter contracts of different sizes means that the platform can accommodate a wide variety of trading styles.

A Novel Dimension of U.S. Crypto Trading Landscape

Perpetual futures contracts—which don’t have a specified expiration date—have been a mainstay of international crypto markets but were mostly limited to U.S. traders because of regulatory restrictions. The decision by Coinbase to offer these types of instruments domestically represents a major market-changing move, allowing traders to hold onto positions without expiry and better protect themselves against volatility in the market. Not only does this make advanced trading tools more widely available, but it also increases the competitive edge of the U.S. derivatives market.

Strategic Collaborations for Regulatory Compliance

Ensuring that all operations meet CFTC regulations, Coinbase has partnered with Nodal Clear for clearing services as it embraces strict regulatory standards in its new venture. Coinbase has consistently prioritized security and can ensure a transparent trading environment, boosting investor trust and establishing a benchmark for industry standards.

The Growing Importance of Crypto Derivatives

And globally, crypto derivatives account for around 75% of the trading volumes, cementing their place within the cryptocurrency ecosystem. Coinbase’s entry adds to its reputation as a global player in market development, while at the same time addressing the increasing appetite for advanced financial products among U.S. investors. Such a step would bolster liquidity and create more efficient price discovery in the domestic market.

Running Ahead with Coinbase

“With our launch of perpetual futures, we are excited to add to our high-quality derivatives offerings and continue helping customers manage their risk in volatile markets while creating more depth in the digital asset ecosystem,”

said Ruholamin Haqshanas, director of product for Coinbase Derivatives Exchange, in the statement. Coinbase ultimately wants to drive innovation in the crypto sector in a way that does not compromise on investor protection. By managing its relationship with regulators and following known guidelines, it is setting an example for how to navigate the dual responsibilities of pioneering new financial technologies while protecting investors.

Why This Risk Is Important for the Broader Crypto Market

The full implications of a major U.S.-based exchange, like that of Coinbase, launching 24/7 perpetual futures trading, will not be truly known for some time. It could create an environment for more competitive, diverse trading with similar domestic platforms applying for approvals. Additionally, improved access to sophisticated trading mechanisms may attract more investors, enhancing cryptocurrencies’ integration into traditional investment vehicles.

A Landmark Event in U.S. Crypto Trading

This era is marked with Coinbase introducing continuous Bitcoin and Ethereum futures trading, a landmark move in the U.S. cryptocurrency market evolution. This not only provides enhanced trading opportunities for traders but also allows Coinbase to contribute to the development and stability of the wider crypto ecosystem by standardizing trading practices to facilitate more market maturity.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. What are Coinbase’s Bitcoin and Ethereum futures, available 24/7?

U.S. traders can now buy, sell, and manage positions of Bitcoin and Ethereum perpetual futures anytime 24/7, using Coinbase for continual access.

2. Understanding Zero-Coupon Perpetual Futures Contracts on Coinbase

Perpetual futures don’t have an expiry date. Traders do not have to worry about positions closing that are not in the money as contracts do not expire, making it much easier to manage risks or a strategy without expiration dates as a concern.

3. Who will be able to trade Coinbase’s 24/7 futures?

This follows Commodity Futures Trading Commission (CFTC) regulation of both institutional and retail futures contracts for U.S.-based traders on Coinbase Derivatives, LLC.

4. Is there risk with 24/7 crypto futures trading?

Yes. Frequent access drives exposure to market volatility. The use of risk management strategies and knowledge of potential losses is crucial before trading perpetual futures.

Glossary of Key Terms

1. Futures Contracts with No Expiration Date: A perpetual futures contract is a futures contract that has no expiration. More often than not, traders can open trades for the long term, granting them exposure to an asset such as Bitcoin or Ethereum indefinitely.

2. 24/7 Trading Station: A trading system that cannot be closed, day or night. This is not unusual in worldwide crypto markets.

3. Coinbase Derivatives LLC: Coinbase’s CFTC-registered exchange that provides services for futures trading It provides access to crypto derivatives markets while enforcing U.S. regulations.

4. Commodity Futures Trading Commission (CFTC): A U.S. agency that regulates futures and derivatives markets. This framework is designed to promote option trading in the United States while ensuring fair practices, protecting investors, and ensuring market integrity on expeditionary trading platforms, such as Coinbase Derivatives LLC.

5. Crypto Derivatives: Contracts whose value is derived from underlying crypto assets such as Bitcoin or Ethereum. Futures, options, and swaps are common types of derivatives.

6. Market Accessibility: The ease with which traders can access financial markets. Coinbase’s 24/7 trading removes the traditional time constraints for U.S. traders and makes crypto much more accessible.

7. Nodal Clear: They partnered with a clearinghouse to settle and guarantee derivatives trades with Coinbase. It provides compliance with the CFTC regulations and mitigates counterparty risk.

8. Risk mitigation techniques: Tools traders can employ to mitigate risk: stop-loss orders, position sizing In perpetual futures markets where leverage and volatility are high, this is key.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)