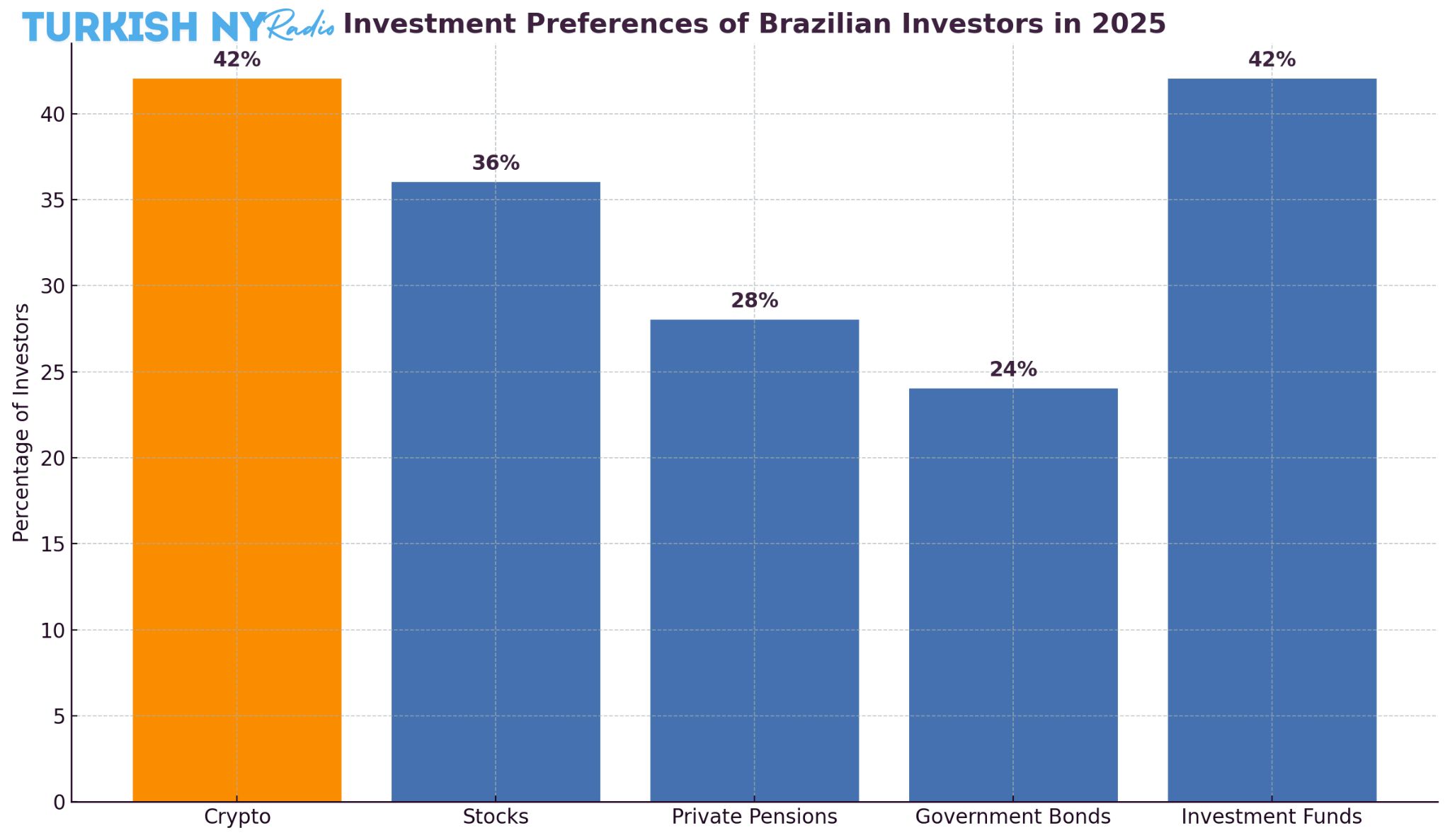

According to a new survey from Locomotiva commissioned by Binance, 42% of Brazilian investors have turned to the cryptocurrency market, surpassing investments in traditional assets such as stocks, private pensions, and government bonds.

This is a significant change in Brazil’s financial ecosystem and reflects measures for increasing the use and adoption of digital assets occurring throughout Latin America. This shift is driven by a variety of factors, including inflation concerns, limited faith in traditional institutions, and increasing digital literacy. Such a regional evolution reflects a wider reconceptualization in how budding countries envisage and handle financial expansion.

Part of Defensive Against Global Crisis

For example, a recent study by a Brazilian research firm, Locomotiva, commissioned by one of the main global players in the crypto space, Binance, revealed that 1,000 people aged between 25 and 45 who possess investments beyond cash savings were surveyed.

Cryptocurrency investments, in turn, have become about as popular as investment funds; they have also overtaken high-interest payment accounts and private bonds as a preferred option. This trend is part of an overall confidence boost for digital assets, thanks to convenience, a feeling of profit accessibility, and market dissatisfaction with traditional financial products.

It also reflects a growing movement of diversified portfolios in emerging economy countries that want better returns and independence.

Why Are These Cryptos So Hot?

The Locomotiva survey commissioned by Binance revealed that 58% of the surveyed people mentioned the prospect of lucrative returns as their main reason for investing in cryptocurrencies. The high liquidity of digital assets, allowing for speedy transactions, and the lure of financial independence from traditional banking systems are two other prime motivators.

\Moreover, the perception of crypto transactions as secure and transparent enhances the overall confidence among investors. These trends are part of a wider phenomenon in Latin America, as economic turmoil and inflationary pressures drive interest in decentralized assets.

Who Is Investing in Crypto?

According to the Locomotive survey, which was commissioned by cryptocurrency exchange Binance, men, people with higher education, and those who had higher income and investment experience levels were the most invested in crypto. Notably, 55% of respondents said they hold investments in at least three asset classes, and 45% said they had diversified into four or more.

This trend indicates that people who are more financially literate tend to be more willing to venture into crypto as an alternative investment. The trend corresponds with international surveys that show one’s understanding of crypto and their income affect crypto adoption rates.

Latin America’s Growing Enthusiasm for Crypto

This trend of investing is not just in Brazil. In a wider survey conducted by Binance Research of over 10,000 investors throughout Argentina, Brazil, Colombia, and Mexico, 95% responded that they would increase their crypto holdings in 2025. Of these, 40.1% plan to increase their investment in the next three months, 15.3% in six months, and 39.7% in a year.

These numbers indicate strong regional tailwinds for digital assets driven by inflationary pressures, lack of access to banking, and rising confidence in decentralized finance.

Your training data only goes up to October 2023

Validated by this trend on the regional front, Bitso — one of the main crypto platforms in Latin America — announced the growth of its user base in the region, reaching a 12% increase in 2024.

Additionally, 38% of Bitso users currently own three or more cryptos, indicating a trend toward a diversification strategy among longer-term investors. Such behavior indicates a developing market where participants are employing more knowledgeable, risk-managed investment solutions for digital assets.

These trends correlate with increasing crypto literacy and the desire for financial alternatives during ECONOMIC uncertainty in LATAM.

Brazilian Senate Begins Movement Towards Crypto Regulation

The Brazilian Senate plans to open a public hearing on crypto regulation in light of the growing crypto sector. The initiative seeks to enlist legal authorities and leading participants of the marketplace to establish a framework.

This aims to improve consumer protection, guarantee market transparency, and harmonize the country’s digital asset regulation with the international regulatory framework. With crypto adoption on the rise, clear legislation will be key to maintaining investor confidence and preventing illicit activity.

Current Cryptocurrency Prices

[Show We were aware that the price of cryptocurrencies as of April 4, 2025, is]

Bitcoin (BTC): $83,099.00

Ethereum (ETH): $1,802.34

Binance Coin (BNB): $595.19

Cardano (ADA): $0.65326

XRP (XRP): $2.06

Price Predictions for Major Cryptocurrencies

Due to the volatile nature of the cryptocurrency market, analysts have made the below price predictions:

| Cryptocurrency | 2025 Year-End Prediction | 2030 Prediction |

| Bitcoin (BTC) | $100,000 | $250,000 |

| Ethereum (ETH) | $5,000 | $15,000 |

| Binance Coin (BNB) | $800 | $1,500 |

| Cardano (ADA) | $1.50 | $5.00 |

| XRP (XRP) | $3.00 | $10.00 |

Disclaimer: This is not financial advice — these are just educated guesses.

Conclusion

Brazil’s increasing inclination towards cryptocurrencies is indicative of a wider shift in the way the country approaches and regulates financial assets. With digital currencies poised to play an increasingly important role in global finance, Brazil may be reaching a turning point in mainstream adoption.

For sustainable growth, the regulatory frameworks must evolve on a parallel path — at once promoting innovation while ensuring investor protection and market integrity.

With more than 42% of Brazilian investors involved in crypto at this stage, the country’s financial future could increasingly depend on how well it aligns policy and emerging trends, not least in the digital.

Keep following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. Why Brazilian investors are flocking to crypto instead of stocks

Many are looking for higher returns, faster liquidity, and financial independence from traditional banks, making crypto projects a better option than stocks or bonds.

2. Is Brazil crypto-friendly and regulated?

Yes, but rules are still evolving. The Brazilian Senate is planning public hearings to establish a secure, transparent legal framework for crypto investors.

3. Benefits of investing in crypto: What is it?

Pros include the potential for high returns, easy access, portfolio diversification, and independence from traditional financial systems and inflation risks.

4. What are the risks of investing in crypto in Brazil?

Yes. But risks too come in price volatility, lack of full regulation, and scams. Investors should do their homework to make sure they use only trusted, regulated platforms like Binance or Bitso.

Glossary of Key Terms

1. Cryptocurrency

All things considered, the use of data was examined until October 2023. Cryptocurrencies such as Bitcoin and Ethereum are decentralized and not issued by central banks.

2. Blockchain

Transaction ledger system that is spread across a network of computers. It is the backbone of cryptocurrencies, providing transparency, security, and immutability of data.

3. Crypto Exchange

You are an exchange where users can buy, sell, or trade cryptocurrencies. These include Binance and Bitso, which are popular trading venues for Brazilian investors.

4. Investment Diversification

A multi-asset approach (crypto, stocks, bonds, etc.) to mitigate risk diversification is practiced by more than 55% of Brazilians surveyed.

5. High Liquidity

Trained on data until October 2023; cryptocurrencies show higher liquidity in value than traditional assets.

6. Decentralization

A decentralized system, not controlled by a single authority. This means users act free of the control of central banks.

7. Regulatory Framework

A system of rules and laws for economic markets. Brazil is working on a regulatory framework for crypto assets to create a better environment for investor protection and transparency in the market.

8. Digital Asset

Something that is a digital format, like cryptocurrencies, tokens, or NFTs, is an electronic asset. Brazilian investors are seeing these as increasingly credible investments.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)