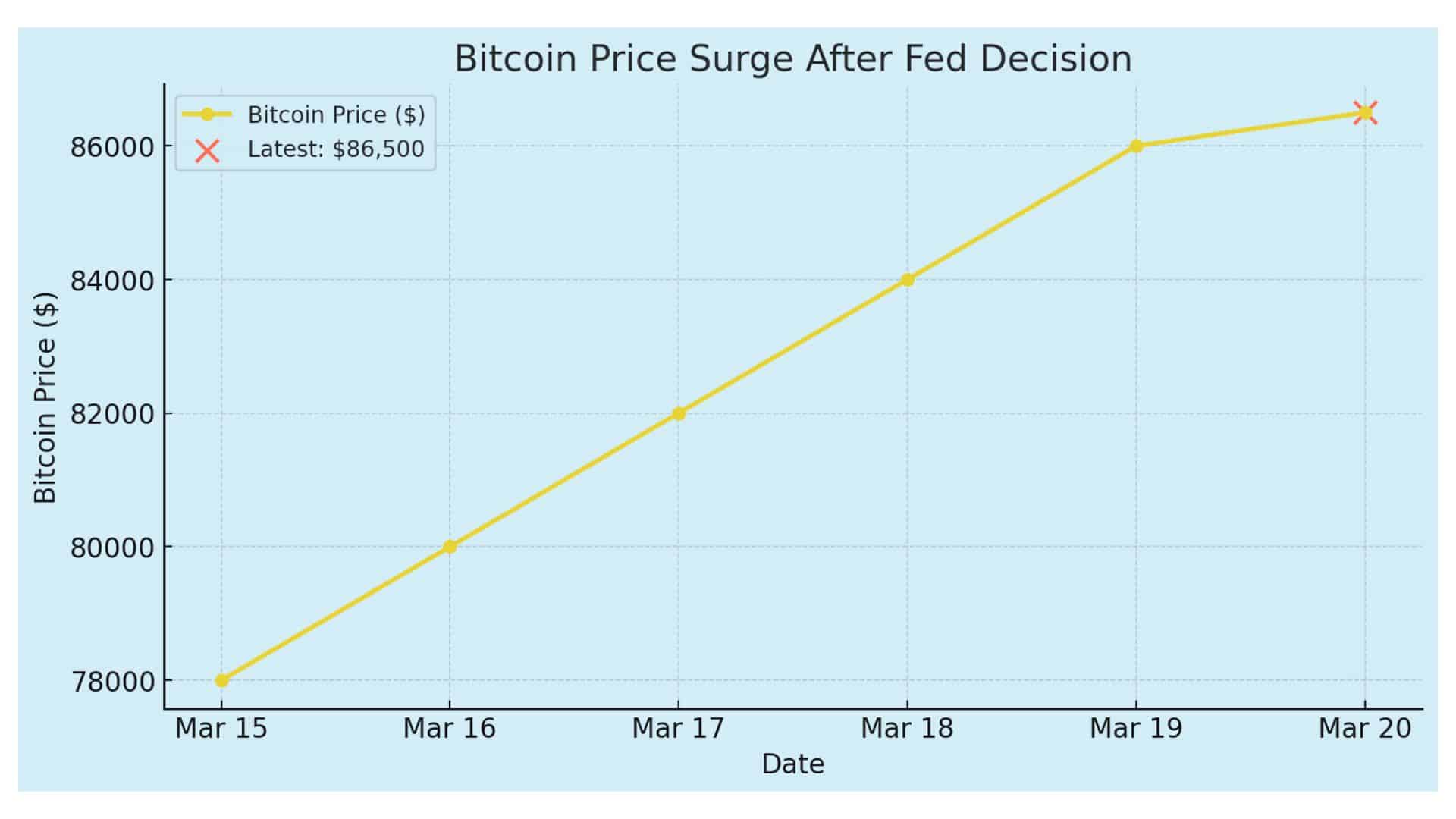

The latest scoop is that Bitcoin has once again made waves in the financial world, surpassing a major price milestone and sparking renewed investor interest, soaring to nearly $86,000 following the Federal Reserve’s latest interest rate decision. T

his rally has fueled excitement across the cryptocurrency space, sending altcoins higher and reigniting bullish sentiment. However, with speculation mounting about future rate cuts and economic uncertainties, many investors are wondering—is Bitcoin on track to hit a new all-time high, or is a correction inevitable?

Let’s break down the key reasons behind this price surge, expert opinions on what’s next, and the potential risks that could impact the market.

Why Did Bitcoin Surge After the Fed’s Meeting?

The Federal Open Market Committee (FOMC) recently announced that interest rates would remain unchanged while also hinting at possible rate cuts later in the year. This announcement sent shockwaves through the markets, leading to a surge in risk assets and stocks.

Key Fed Takeaways That Boosted Bitcoin’s Price:

Rate Cuts Expected – The Fed signaled up to two interest rate cuts in 2025, suggesting an economic easing policy that historically benefits assets like Bitcoin.

Quantitative Tightening (QT) Adjustment – The Fed reduced its monthly cap on Treasury redemptions from $25 billion to $5 billion, injecting more liquidity into the market.

Investor Optimism – With interest rates expected to decline, traditional savings and bond investments may become less attractive, pushing more investors into Bitcoin and other alternative assets.

These monetary policy shifts have strengthened Bitcoin’s appeal as a hedge against inflation and a store of value, driving its price up.

Bitcoin Hits $86K – Can It Break $90K?

The recent rally has analysts eyeing the next psychological resistance at $90,000, a key level that could determine whether the bull run continues.

Short-Term Outlook: If buying momentum remains strong, experts predict that Bitcoin could soon test $90K before facing a potential retracement.

Potential Corrections: Some analysts caution that Bitcoin may experience a temporary pullback, with key support levels around $80,000-$82,000 where buyers might step in.

On-Chain Data: Metrics from Glassnode and CryptoQuant suggest that long-term holders are still accumulating, reducing selling pressure and increasing confidence in further price gains.

Overall, market sentiment remains bullish, especially as institutional investors continue increasing their exposure to Bitcoin.

Altcoins and Stocks React

Bitcoin’s rally has sparked gains across the cryptocurrency market, lifting major altcoins and traditional assets.

Ethereum (ETH): Surpassed $2,000, riding the wave of Bitcoin’s bullish momentum.

Solana (SOL): Registered double-digit percentage gains, fueled by strong DeFi activity.

XRP: Jumped 10% after Ripple’s legal victory against the SEC.

Traditional markets also reacted positively. U.S. stock indices rose, and Treasury yields slipped, signaling growing optimism following the Fed’s announcement.

What Could Stall Bitcoin’s Rally?

Despite the positive momentum, Bitcoin’s price is not immune to potential risks. Here are some factors that could trigger volatility or a correction:

Regulatory Crackdowns – Governments worldwide are tightening their grip on cryptocurrencies, which could slow down institutional adoption or impact trading activity.

Geopolitical Tensions – Conflicts, economic instability, or sudden market shifts could lead to a flight to safety, causing investors to withdraw from riskier assets like Bitcoin.

Profit-Taking – If Bitcoin reaches $90K-$95K, some large investors may cash out profits, leading to temporary price dips and increased volatility.

While these risks don’t necessarily signal a bear market, they are crucial factors to watch as Bitcoin navigates this critical price zone.

Is Bitcoin Still a Smart Investment?

Bitcoin’s recent $86,000 surge showcases its resilience as an asset and its growing role in global financial markets. With potential interest rate cuts ahead, macroeconomic conditions could continue supporting its long-term growth.

For Long-Term Investors: Holding through short-term fluctuations could be rewarding, as Bitcoin remains a hedge against inflation and economic uncertainty.

For Short-Term Traders: Volatility presents opportunities, but risk management is essential to avoid getting caught in price swings.

As Bitcoin hovers near historic highs, the next few weeks will be critical in determining whether $90,000+ is on the horizon—or if a healthy correction is due.

Final Word

Bitcoin remains at the center of global financial discussions, and its $86,000 price level reflects the growing confidence in crypto as a legitimate asset class. Whether it breaks $90K or faces a correction, one thing is certain—Bitcoin’s journey is far from over.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

Why did Bitcoin surge to $86,000 after the Fed’s decision?

Bitcoin surged due to the Federal Reserve’s signals of potential interest rate cuts, which increased investor confidence and demand for risk assets like Bitcoin.

Will Bitcoin reach $90,000 or is a correction coming?

Analysts believe Bitcoin could test $90K if momentum continues, but short-term corrections around $80K–$82K are also possible due to profit-taking.

How does the Fed’s monetary policy impact Bitcoin’s price?

Lower interest rates and increased liquidity make traditional assets less attractive, pushing investors toward Bitcoin as a hedge against inflation and economic uncertainty.

What risks could affect Bitcoin’s rally?

Regulatory crackdowns, geopolitical tensions, and profit-taking by investors could trigger volatility and potential short-term declines.

Glossary of Key Terms

Bitcoin (BTC): The world’s largest cryptocurrency, often seen as a store of value and hedge against inflation.

Federal Open Market Committee (FOMC): The U.S. Federal Reserve body responsible for setting interest rates and monetary policy.

Interest Rates: The cost of borrowing money; lower rates often drive investors to riskier assets like Bitcoin.

Quantitative Tightening (QT): A policy where the Fed reduces its balance sheet to control inflation, impacting market liquidity.

Resistance Level: A price ceiling where an asset faces selling pressure, such as Bitcoin’s next key level at $90,000.

Support Level: A price floor where buyers step in, with Bitcoin’s support estimated at around $80K-$82K.

Altcoins: Cryptocurrencies other than Bitcoin, including Ethereum (ETH), Solana (SOL), and XRP.

Macroeconomic Factors: Large-scale economic trends, such as inflation, employment, and interest rates, that impact financial markets, including crypto.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)