BlackRock’s subsidiary, BlackRock International Ltd., has been officially registered as a digital asset firm by the UK’s Financial Conduct Authority (FCA). This allows the company to serve as an arranger of crypto-backed Exchange Traded Products (ETPs), but it is a service that is limited only to its client iShares Digital Assets AG.

As part of this role, BlackRock is in charge of aiding the execution of crypto asset transactions in order to facilitate ETP subscriptions and redemptions between the issue and authorized participants, promoting regulated institutional access to digital assets in the UK.

Implications for Institutional Investors

BlackRock’s FCA registration is expected to enhance access to regulated digital asset products for institutional investors in the UK. Previously, investing in foreign-issued crypto ETPs posed regulatory and operational challenges. With this move, BlackRock streamlines the process, reducing key barriers and offering institutions a more secure and compliant entry point into the crypto market. This aligns with growing institutional interest in Bitcoin and other digital assets, especially following the global surge in crypto-backed ETFs.

Challenges of Retail Investor Access and Regulatory Constraints

The FCA did put some limits on BlackRock’s crypto-related business, however. The firm is only licensed to service its single client, iShares Digital Assets AG, and is forbidden from taking on other clients without prior written agreement from the FCA. In addition, without regulatory approval, BlackRock is prohibited from running any automated systems that would allow crypto-to-fiat or fiat-to-crypto transactions. So under these conditions, the crypto ETPs that BlackRock plans cannot be accessed by retail investors in the UK. These measures indicate the FCA’s cautious approach to consumer protection in crypto markets.

Performance and Impact of iShares Bitcoin ETP

The iShares Bitcoin ETP, released from iShares Digital Assets AG, now trades on major European exchanges, including Deutsche Börse Xetra, Euronext Paris, and Euronext Amsterdam. Date: Apr 2, 2025; Tracker ETP NAV: 49.10; Daily Growth: 1.61% The stock has traded as low as $30.24 over the past year and as high as $60.61, both signs of increased investor interest and considerable market volatility. These trends mirror larger trends in institutional adoption and digital asset price dynamics.

What Does Bitcoin Market Look Like Today

April 3, 2025 — Bitcoin Price: $83,000 The wider crypto market is still highly volatile, partly due to recent geopolitical events. Fresh tariff announcements from former President Donald Trump have contributed to uncertainty and left investors apprehensive amid ambivalent market sentiment. These macroeconomic factors remain highly relevant to short-term crypto price dynamics, highlighting the asset class’s sensitivity to global policy decisions.

Bitcoin Price Forecast: Future Predictions

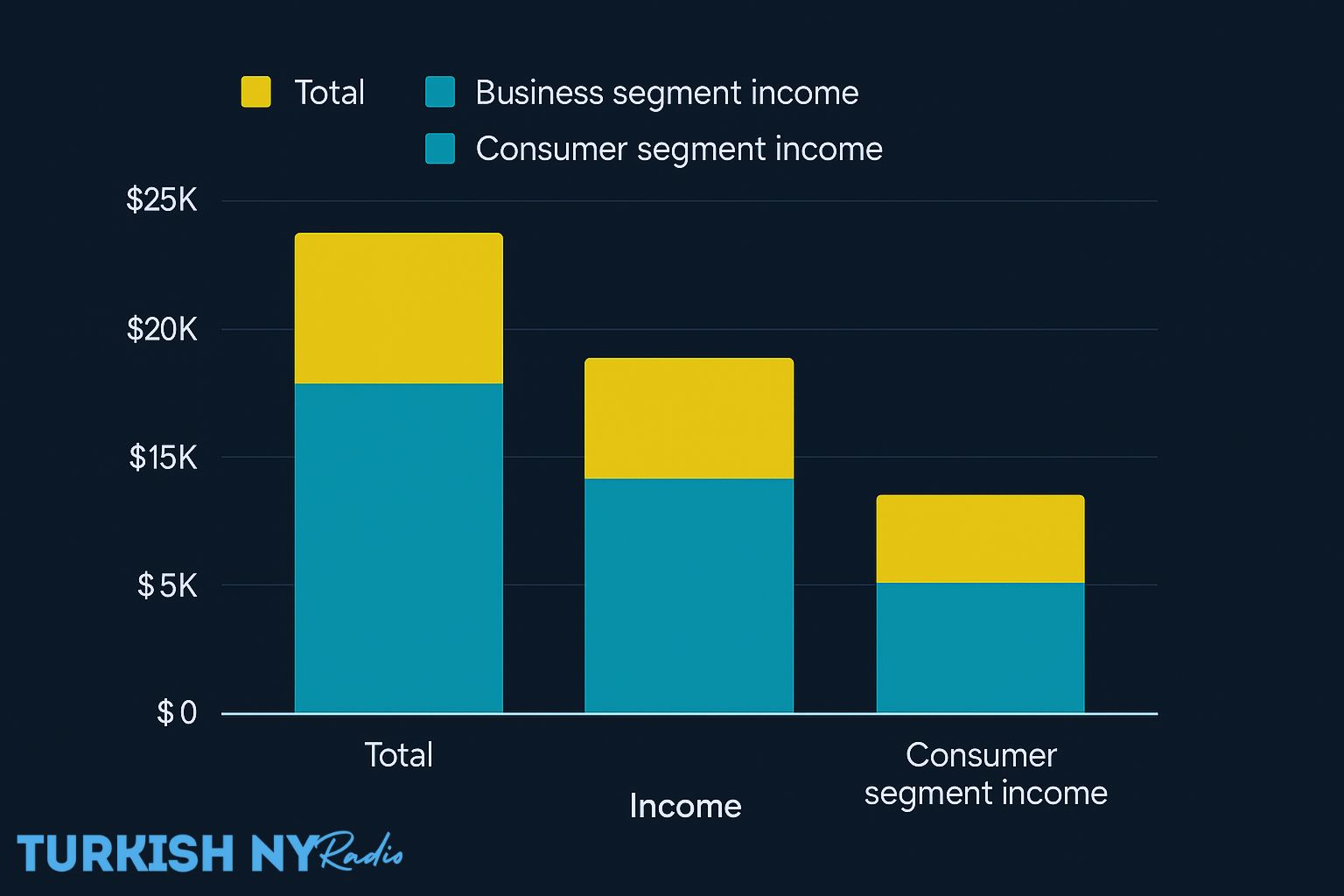

Here’s what analysts are predicting for Bitcoin price in the years to come:

Year |

Predicted Price (USD) |

| 2025 | $83,313.67 |

| 2026 | $87,481.45 |

| 2027 | $91,855.52 |

| 2028 | $96,448.30 |

| 2030 | $106,334.25 |

These predictions indicate a continuous increase in the price of Bitcoin, supported by robust institutional adoption, regulatory advancement, and macroeconomic challenges.

Conclusion

Recently, BlackRock, a multinational investment management corporation based in New York, received approval from the UK’s Financial Conduct Authority (FCA), which would sound the starting horn for institutional crypto investment in England. BlackRock is also bridging traditional finance and the digital asset space by providing regulated outlets for institutional capital to enter the economy through crypto-backed ETPs.

These products are still off-limits to retail investors, but the move further highlights the increasing embrace of digital assets among mainstream financial systems. And it also reflects the growing role of regulated institutions in determining crypto’s future.

Keep following us on Twitter and LinkedIn, and join our Telegram channel for more news.

Frequently Asked Questions

Q1: Why does the asset manager’s UK approval matter to institutional investors?

A1: The green light essentially grants large firms regulated pathways to digital asset products, further building trust, security, and long-term viability into token-based investment offerings.

Q2: What type of exchange products can be backed by digital assets?

A2: Professional investors need safe exposure to virtual currencies at the intersection between regulated financial services and teams with deep financial backgrounds to construct the tools that dealers and investors use in both traditional and nontraditional capital markets.

Q3: But why can’t everyday investors get their hands on these digital asset products?

A3: Under current UK rules, consumers are prevented from access, as consumers can only participate through licensed institutions for safety, compliance, and financial protection reasons.

Q4: What does UK approval mean for virtual asset investments?

A4: It is an incremental step that can promote wider market confidence and allow financial institutions to innovate with tokenized investments, with an underlying regulatory framework to safeguard investor interests at play.

Glossary of Key Terms

1. Digital Asset

Digital asset: Something of value that is stored in electronic format, typically on a blockchain. It encompasses cryptocurrencies such as Bitcoin and Ethereum, as well as tokenized versions of other assets. In an institutional setting, digital assets are traded via regulated platforms for security and compliance.

2. Exchange Traded Product (ETP)

An ETP is a security that follows the value of an underlying asset or a group of assets and is available on traditional stock exchanges. Crypto-backed ETPs offer exposure to digital currencies without the need to own the underlying tokens.

3. Institutional Investor

These are the organizations — like hedge funds, pension funds, and insurance companies — that put big money into financial markets. Unlike retail investors, they tend to participate in markets using more exclusive and regulated vehicles, such as ETPs.

4. Authorization (Regulatory Approval)

This refers to an official approval issued by a financial regulator that allows a firm to conduct business in a particular financial area. That’s critical for digital assets because, without them, investors don’t know if they can trust them.

5. Arranger (in Finance)

As the name suggests, an arranger acts on behalf of the issuer to arrange a debt or investment vehicle, in this case an ETP. In other words, the arranger is the one that manages transactions, liquidity, and regulatory compliance between issuers and investors in digital asset markets.

6. Retail Investor

A retail investor refers to an individual who purchases and sells securities for his or her own personal account and not on behalf of an organization or company. That won’t stop retail access to digital asset products, because retail access to digital asset products is often limited by regulatory concern about risk and volatility.

7. Net Asset Value (NAV)

NAV, or the net asset value, is the value of one share of a fund or ETP based on the value of all of its assets less its liabilities. NAV assists investors in determining the current fair price of the product in digital asset ETPs.

8. Tokenization

Tokenization refers to the conversion of either real-world or digital assets into blockchain tokens. This allows assets to trade on decentralized systems that are also more secure, transparent, and liquid — a model that’s being adopted for more and more of traditional finance.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)