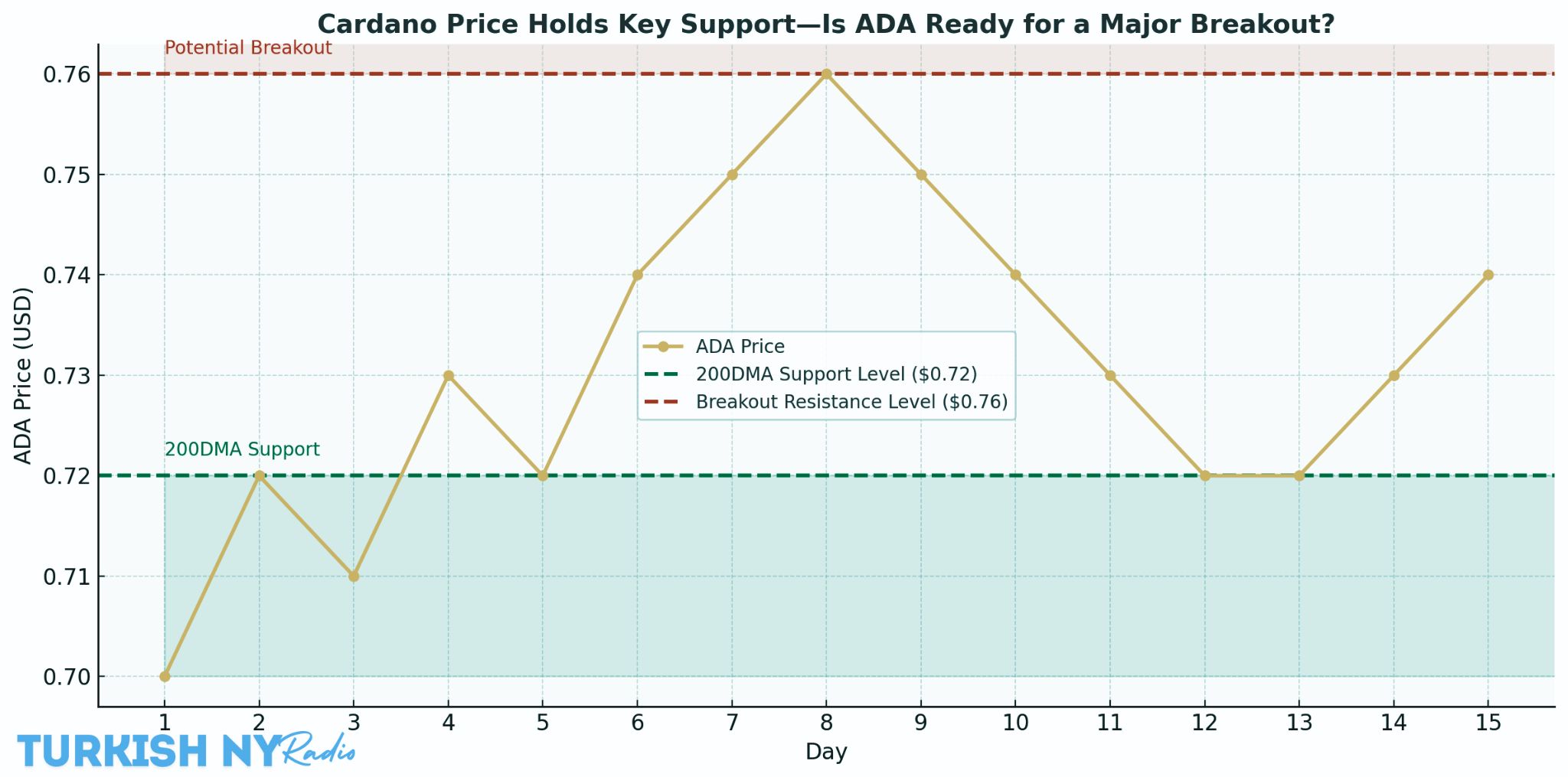

ADA (also known as Cardano) is increasingly in the spotlight as the cryptocurrency trades above the 200-day moving average (200DMA), which has long been a key support level. ADA’s price has previously rebounded strongly after testing this key threshold, making it a focal point for traders seeking possible entry points. Although the 200DMA indicates a possible direction towards support, recent systemic developments such as the Federal Reserve’s monetary policy behavior expose vulnerabilities within broader market forces. Before making a decision, investors ought to balance the technical signals with fundamental factors. Technically, ADA is trading at around $0.7176 as of March 21, 2025.

ADA Bouncing Off 200DMA

ADA’s price has traded decisively above its 200DMA for the last six weeks, reinforcing the level as significant support. ADA did test this support in early February and rallied over 50% in ten days. Exactly such a pattern occurred in late February, resulting in an 80% spike then. Currently on March 21, 2025, the ADA is being traded at 0.717615 with a change of -0.01849% from the previous closing.

Moving the Market

Technical indicators are showing bullish signals on some fronts, but the overall market situation is far more ambiguous. The early March speculation surrounding ADA’s addition to a planned strategic U.S. crypto reserve sent it on a steep rally. However, this inclusion never came and led to a retracement. Other words that came up were unmet expectations regarding a meeting between Cardano founder Charles Hoskinson and key officials in the Trump administration—Hoskinson was not invited to a recent crypto event.

Such outcomes emphasize the need to realign market expectations at a respective pace with underlying fundamentals. The excitement soon turned sour and ultimately led to ADA’s current price, roughly 40% lower than its peak in the past month.

The Mazes of the Federal Reserve

Recent monetary policy decisions made by the Federal Reserve have had an impact on the crypto market as well. A slowdown in quantitative tightening was seen as a good sign for digital assets. Nevertheless, nagging fears of economic growth and inflation continue to loom over market sentiment. Such macroeconomic uncertainties may lead to additional downturns in the crypto market, jeopardizing ADA’s 200DMA support.

Where Could ADA Drop?

A failure to hold above the 200DMA would be the first sign that ADA is entering the bears. According to analysts, ADA may also drop to test its February lows at the $0.55 level. In a more pessimistic scenario, the price may drop to the mid-$0. 40s, consistent with the peaks seen in mid-2024. citeturn0search10

Those considering ADA should balance potential gains with the risks involved. When it comes to its real-world adoption prospects, the blockchain platform for Cardano has the potential to fly high thanks to its unique capabilities and is hoping to become a popular platform for decentralized finance, or DeFi, applications. But relative to the likes of Bitcoin, Ethereum, and Solana, Cardano’s level of adoption has been on the weak side21.

Notably, the current U.S. administration has the crypto industry on its side. President Trump has recently echoed this position but emphasized the administration’s plan to encourage growth within the industry. citeturn0search13 A nurturing atmosphere, however, may actually serve ADA fairly well if investors take caution and invest in other cryptocurrencies that would prove a higher rate of adoption.

ADA Price Projections

| Source | Forecasted Price Range / Estimate | Timeframe | Notes |

|---|---|---|---|

| CoinCodex | $0.683561 – $1.273546 | 2025 | The average price prediction is around $0.95. |

| Changelly | $0.69 | March 22, 2025 | The forecast suggests a 3.97% decrease. |

| Binance | $0.917494 | By 2030 | A more conservative long-term price estimate. |

These estimates reflect the volatility and unpredictability of the market for cryptocurrencies itself. Always do additional research and consult with an investment professional before making decisions.

Is it a Good Time to Invest in ADA?

For investors able to buy in at or above ADA’s position at the 200DMA, an attractive entry point may be available. That said, make no mistake, there were many factors at play, both internally and in the outside economic environment, that are telling investors to approach with caution. It is important to consider that Cardano’s long-term potential is promising, but the volatility of the cryptocurrency market means that investors must engage in strategic and informed decision-making if they choose to invest in ADA.

Disclaimer: This is not financial advice, but a consideration for long-term holding in ADA.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

Frequently Asked Questions

Q1: Is ADA A BUY While Above 200DMA?

Holding Cardano above its 200DMA may be a good encouraging sign, but invest with a risk analysis of macroeconomic factors and market conditions.

Q2: What are the risks of Cardano’s price in the short term?

The main risks include shifts in Federal Reserve policy, economic uncertainty, and diminished expectations for crypto adoption after some recent disappointments in terms of institutional support.

Q3: What is the 200DMA, and why is it important for ADA?

200DMA is a long-term support level. Being above it more often means stability and bullish momentum.

Q4: How do analysts expect Cardano price movements to unfold in the future?

Analysts have forecast ADA to range between $0.68 and $1.27 during 2025, with a $0.91 level during 2030 regarded as a conservative long-term outlook.

Glossary of Key Terms

1. Two Hundred Day Moving Average (200DMA)

A long-term technical indicator that computes the average of an asset’s closing price for the previous 200 days. This can help spot vital support or resistance levels. For example, in Cardano’s case, the 200DMA is currently functioning as an important point of support for price stability.

2. Support Level

A price level where buying interest in an asset tends to surface that halts the decline. The 200DMA for Cardano is a key support area for traders to watch for a bounce.

3. Resistance Level

The opposite of support; it’s a price point at which selling pressure usually keeps the price from rising further. The potential breakout resistance for Cardano lies around $0.76.

4. Breakout

A breakout happens when the price of an asset breaks decisively above a resistance point or below a support point. Traders use breakouts to indicate the start of a new price trend, with Cardano potentially breaking above $0.76 to gain more altitude.

5. Quantitative Tightening (QT)

Monetary policy in which central banks withdraw liquidity by selling or allowing assets to mature. Slowing QT by the Fed affects crypto markets through risk appetite.

6. Macro Conditions

Broader economic influences on the overall financial market, such as inflation, interest rates, and monetary policy. Negative macro conditions can weigh on Cardano and other cryptocurrencies.

7. Decentralized Finance (DeFi)

A system to borrow, stake, and trade on the blockchain, which does not require intermediaries. Cardano seeks to become a leading player in DeFi ecosystems that focus on Bitcoin.

8. Market Correction

A brief reduction in asset values, especially after a period of overgrowth or speculation. The recent price fall of Cardano after disappointment from hype is a classic example of price correction market patterns.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)