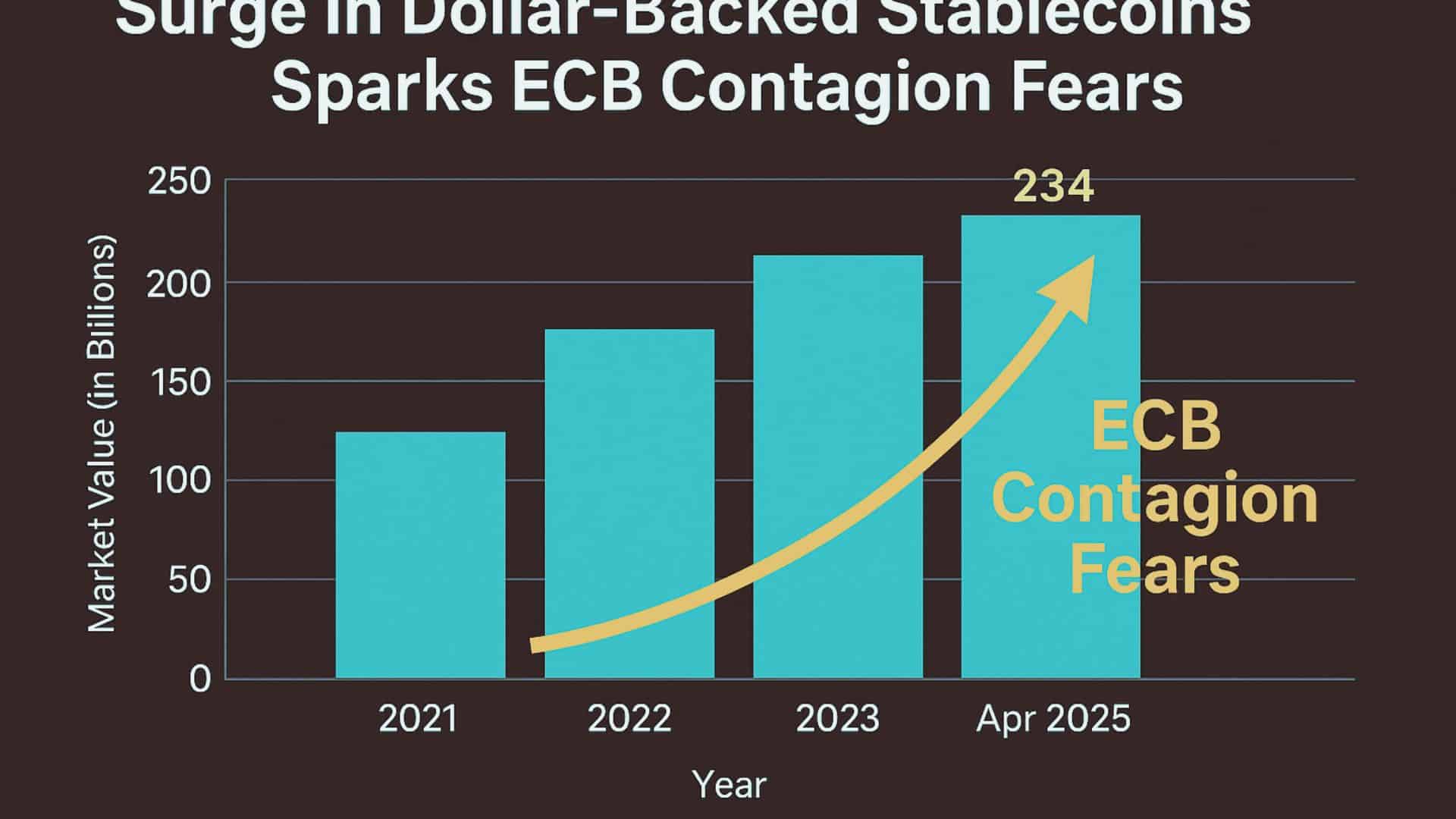

Frankfurt, April 22, 2025 — The European Central Bank (ECB) flags growing risks to European financial sovereignty as U.S.-backed stablecoins continue to expand their presence in global markets.

In a sharp critique, ECB flags dollar-denominated stablecoins—like USDC and USDT—as potential disruptors to the EU’s financial system, citing dangers that include capital flight, bank liquidity shocks, and weakened monetary control.

“If left unchecked, these stablecoins could undermine Europe’s monetary autonomy,” the ECB flags report warns.

Why ECB Flags Stablecoins Now

The U.S. has recently ramped up its push for a formalized stablecoin framework, with bipartisan support growing for regulation that would legitimize and integrate stablecoins into the traditional financial system. In response, the ECB flags this as a direct threat to European control over its digital economy.

-

ECB flags the risk of Europeans turning to dollar-backed crypto in the absence of strong EU-native alternatives.

-

ECB flags that MiCA—the EU’s flagship crypto law—may not be robust enough to contain foreign stablecoin risks.

Market Reaction: Bitcoin and Stablecoins Hold Steady

Following the release of the ECB flags report, crypto markets showed mixed reactions. Bitcoin (BTC) traded at $66,420, down 1.3% on the day, while Ethereum (ETH) slipped 0.9% to $3,230. Notably, dollar-backed stablecoins such as USDT and USDC maintained their pegs but saw a slight uptick in on-chain volume, suggesting cautious movement among European traders.

Analysts say the market is still processing the implications of the ECB’s stance, with many watching closely for any changes to MiCA or hints of accelerated digital euro development.

MiCA May Need Upgrades

The ECB flags potential gaps in the current Markets in Crypto-Assets Regulation (MiCA), which was introduced to regulate crypto assets and stablecoins in the EU.

Though MiCA introduces caps and oversight for stablecoin issuers, the ECB flags the lack of specific enforcement mechanisms that would prevent U.S.-based stablecoins from dominating euro markets.

“Without amendments, MiCA could fall short. ECB flags the need for stricter thresholds and real-time oversight,” said an ECB official.

EU Commission Not Aligned

Despite the warnings, the European Commission has dismissed the ECB’s concerns, stating that MiCA remains sufficient to manage existing risks. According to the Commission:

-

MiCA already includes reserve requirements, issuance limits, and licensing frameworks.

-

ECB flags are seen as preemptive rather than urgent by Commission officials.

This division reflects a broader debate within the EU about how aggressively to regulate crypto—and whether Europe’s current rules are fit for the fast-changing global market.

The Dollar vs. The Euro in the Crypto Age

At the heart of the issue: ECB flags the rising dominance of the dollar in the digital asset space. With stablecoins mostly pegged to USD and backed by U.S. institutions, ECB flags the danger of digital dollarization in Europe.

To counterbalance this, the ECB is pushing for accelerated development of the digital euro, which it hopes will offer a trusted, EU-controlled alternative.

“The longer we delay, the stronger U.S. stablecoins become. ECB flags this as a defining moment for digital sovereignty.”

Global Implications

This isn’t just a European issue. As ECB flags these concerns, they echo globally. Countries like Japan and India are also exploring regulatory models to resist dollar-backed digital assets.

The ECB flags debate may influence how other central banks approach crypto regulation in the context of national financial security.

Conclusion

As the ECB flags the growing threat of U.S.-backed stablecoins, the message is clear: Europe must act fast or risk falling behind in the global crypto race. While U.S. regulators embrace digital dollars, the EU faces a critical moment to protect its financial independence.

Whether it’s through tightening MiCA, accelerating the digital euro, or challenging the dominance of dollar-pegged tokens, the next move is Europe’s to make.

The question is no longer if stablecoins will reshape the financial world—it’s who will control that future.

Follow us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. Why does the ECB flag U.S. stablecoins as a financial risk?

The ECB flags them due to concerns over monetary control, capital outflows, and liquidity risks for EU banks. With most stablecoins pegged to the U.S. dollar, their rise could erode the euro’s role in digital finance.

2. What is MiCA, and why does the ECB flag it for revision?

MiCA (Markets in Crypto-Assets Regulation) is the EU’s crypto rulebook. The ECB flags it as potentially too weak to prevent U.S.-backed stablecoins from flooding the European market.

3. How could stablecoins hurt European financial sovereignty?

The ECB flags that widespread adoption of dollar-backed stablecoins in Europe could shift financial power to the U.S., limit the ECB’s ability to manage monetary policy, and create dependency on foreign reserves.

4. Is the European Commission ignoring ECB concerns?

The Commission acknowledges the discussion but does not agree with the urgency. It claims that MiCA already includes safeguards. Still, the ECB flags the need for stronger, faster regulatory updates.

5. Could the digital euro fix this issue?

Yes, the ECB flags the digital euro as a key solution—a sovereign, euro-pegged alternative to U.S. stablecoins that would support European monetary independence in the digital age.

Glossary

ECB (European Central Bank)

The central bank for the eurozone. It sets monetary policy, manages the euro, and ensures financial stability in the EU.

Stablecoin

A type of cryptocurrency that is pegged to a stable asset—typically a fiat currency like the U.S. dollar or euro. Common examples include USDC and USDT.

MiCA (Markets in Crypto-Assets Regulation)

A comprehensive EU law designed to regulate crypto assets, including stablecoins. It covers licensing, reserves, and operational conduct for issuers and service providers.

Digital Euro

A proposed central bank digital currency (CBDC) from the ECB intended to serve as a digital version of the euro, aiming to counter the dominance of foreign stablecoins.

Dollarization (Digital Dollarization)

The economic phenomenon is where countries increasingly rely on the U.S. dollar instead of their local currency. In this case, the ECB flags a digital form of dollarization via stablecoins.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)