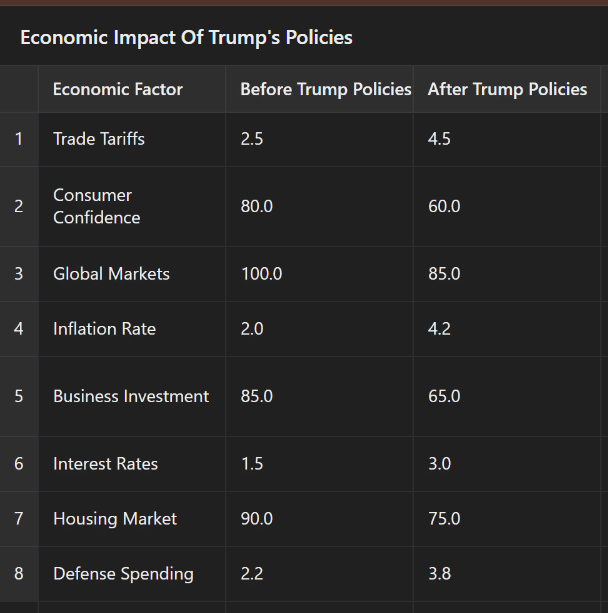

According to the sources, Trump’s economic policies are once again under the spotlight, but this time, the European Central Bank (ECB) is sounding the alarm. According to ECB Vice-President Luis de Guindos, Trump’s approach to trade, tariffs, and deregulation could create more economic instability than the COVID-19 crisis.

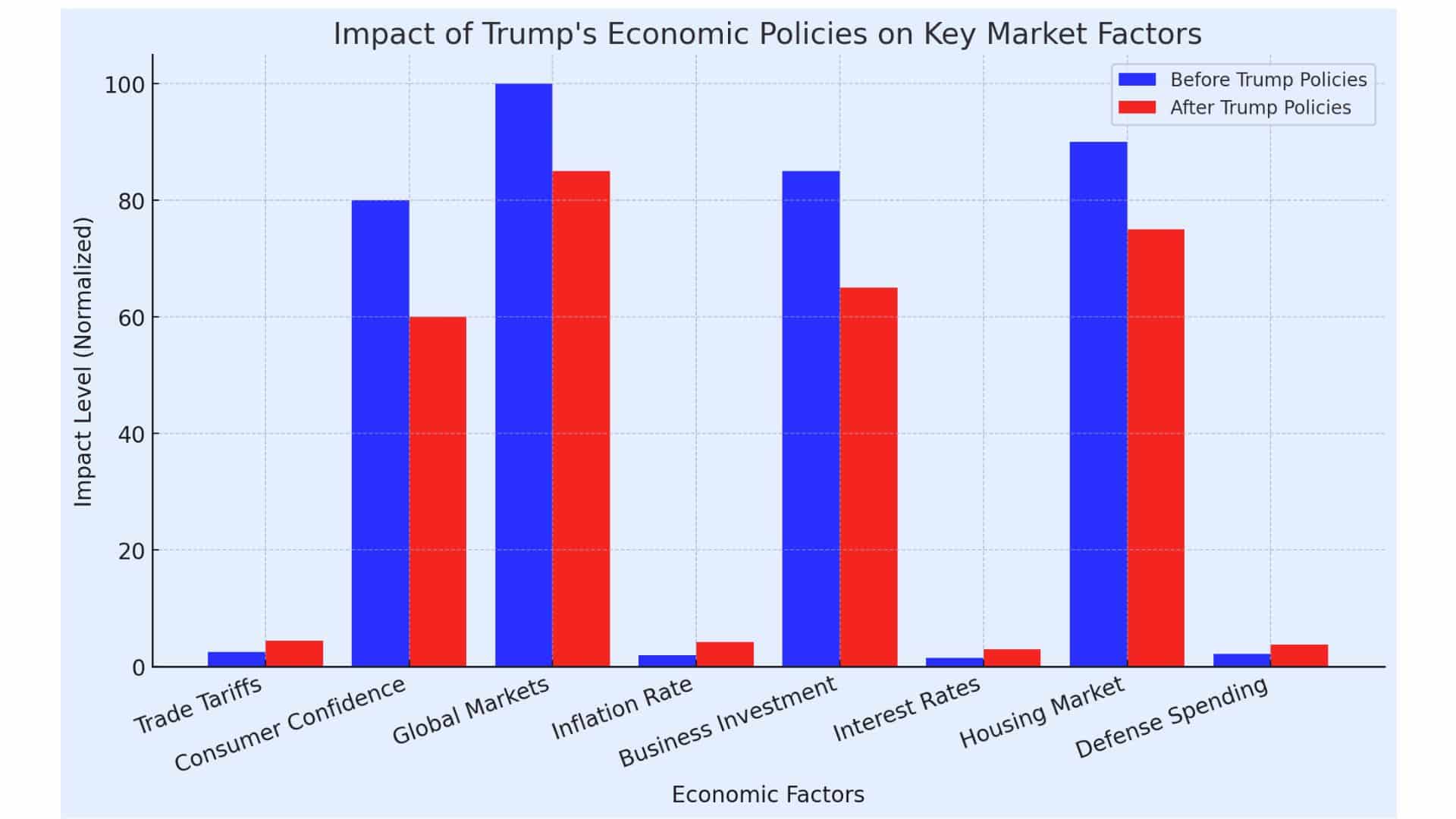

Experts warn that the financial landscape could face unpredictable challenges due to the possibility of soaring inflation, disrupted global markets, and shaken consumer confidence. But how exactly could Trump’s policies reshape the economy, and what does it mean for businesses, investors, and everyday consumers? Let’s dive into the key risks and potential consequences ahead.

The Rising Threat of Economic Instability

The ECB believes Trump’s economic policies could trigger a wave of instability due to his plans for increased tariffs and a shift away from multilateral cooperation. This approach, favoring protectionism, has already sparked fears of inflation spikes and interest rate fluctuations.

Unlike the pandemic, which was a global crisis requiring collective recovery measures, Trump’s policies could create long-term economic uncertainty, making it difficult for central banks to maintain stability.

How Trump’s Policies Affect Global Trade

One of the ECB’s main concerns is the shift toward aggressive trade policies. Trump has expressed interest in imposing higher tariffs on imports, which could lead to retaliatory measures from other countries.

A full-scale trade war would hurt global economic growth, disrupt supply chains, and drive up consumer prices. The ECB warns that businesses and investors are already reacting cautiously due to the unpredictability of future trade regulations.

Consumer Confidence and Business Investment Decline

Despite wage growth and declining inflation in the eurozone, consumers remain hesitant to spend, and businesses are delaying investments. This uncertainty stems from fears of prolonged trade wars, unpredictable tax policies, and geopolitical tensions.

De Guindos emphasizes that this hesitation is holding back economic recovery despite otherwise favorable financial conditions. If businesses continue delaying investment, job creation and economic growth could suffer.

The Risk of Inflation and Interest Rate Spikes

Trump’s economic policies could lead to rising inflation, forcing central banks to adjust interest rates more aggressively than expected.

With an uncertain trade environment, the cost of goods could increase, leading to higher consumer prices. The ECB has already signaled caution, as unexpected inflation surges could disrupt financial stability across global markets.

Defense Spending: A Double-Edged Sword

As Trump pressures NATO allies to increase defense spending, European countries may be forced to allocate more funds toward military budgets.

While this could stimulate short-term economic growth, it also raises concerns about potential tax increases or cuts in public spending elsewhere. The ECB warns that unbalanced government spending could have long-term economic consequences.

Trump’s Impact on the Housing Market

The ECB highlights that national governments must take action to improve housing markets amid economic uncertainty. Rising interest rates and shifting investment patterns could impact affordability.

If Trump’s economic decisions create instability in financial markets, the housing sector could face challenges similar to those seen in previous economic crises.

A Call for Global Cooperation Over Confrontation

ECB officials stress the need for negotiation and cooperation to prevent unnecessary trade disputes. Olli Rehn, a key ECB policymaker, urges global leaders to work toward balanced economic policies rather than escalating conflicts that harm both sides.

The central message from the ECB is clear: the world must navigate economic risks through diplomacy and long-term planning rather than reactive trade wars and financial uncertainty.

Conclusion: Will Trump’s Policies Shape the Next Economic Crisis?

The ECB’s warning serves as a crucial reminder that economic policies have far-reaching consequences. While Trump’s approach may appeal to certain political and business interests, the broader implications suggest potential instability in global markets.

As the world watches the unfolding economic landscape, central banks, businesses, and consumers must prepare for both opportunities and risks ahead. Whether Trump’s policies lead to growth or chaos remains to be seen—but the ECB is making it clear that caution is warranted.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. How do Trump’s economic policies impact global markets?

Trump’s policies, including tariffs and deregulation, create uncertainty, disrupt trade, and can lead to inflation and financial instability.

2. Why is the ECB warning about Trump’s economic strategies?

The ECB believes Trump’s policies could destabilize markets more than COVID-19, causing inflation spikes, reduced investments, and trade conflicts.

3. Could Trump’s policies trigger a recession?

Yes, if aggressive tariffs and economic isolation continue, they could slow growth, hurt consumer confidence, and lead to a global downturn.

4. What does the ECB suggest to counter these risks?

The ECB urges global cooperation, stable trade policies, and careful monetary measures to prevent unnecessary economic shocks.

Glossary of Key Terms

Trump’s Economic Policies – A set of trade, tax, and financial regulations introduced by former U.S. President Donald Trump, often focusing on protectionism, deregulation, and corporate tax cuts.

European Central Bank (ECB) – The central bank responsible for managing monetary policy in the Eurozone, including inflation control, interest rates, and economic stability.

Trade Tariffs – Taxes imposed on imported goods, often used as a protectionist measure to encourage domestic production but can also lead to trade wars.

Monetary Policy – The process by which central banks, like the ECB, manage money supply, interest rates, and credit availability to maintain economic stability.

Trade War – An economic conflict between countries involving escalating tariffs and restrictions on imports and exports, often harming global economic growth.

Fiscal Policy – Government decisions on taxation and spending used to influence economic growth, job creation, and inflation control.

Deregulation – The process of reducing or eliminating government rules and restrictions on businesses, often aimed at encouraging growth but sometimes leading to financial risks.

Deficit Spending – When a government spends more than it earns in revenue, often leading to increased national debt and inflation risks.

GDP (Gross Domestic Product) – The total value of goods and services produced within a country, a key indicator of economic health.

NATO Defense Spending – The financial contributions made by NATO member countries toward collective defense, sometimes influenced by U.S. policies.

Sources

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)