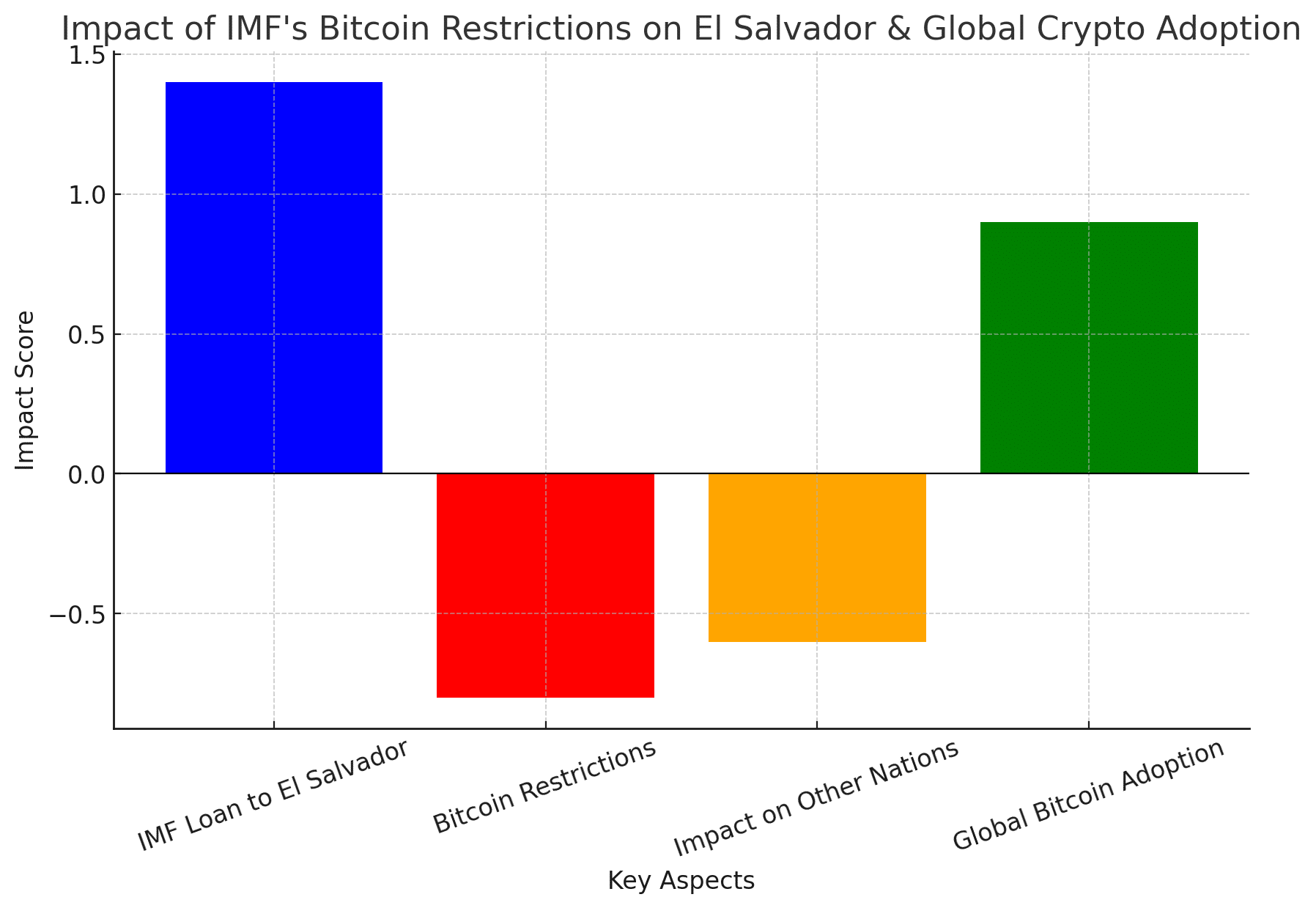

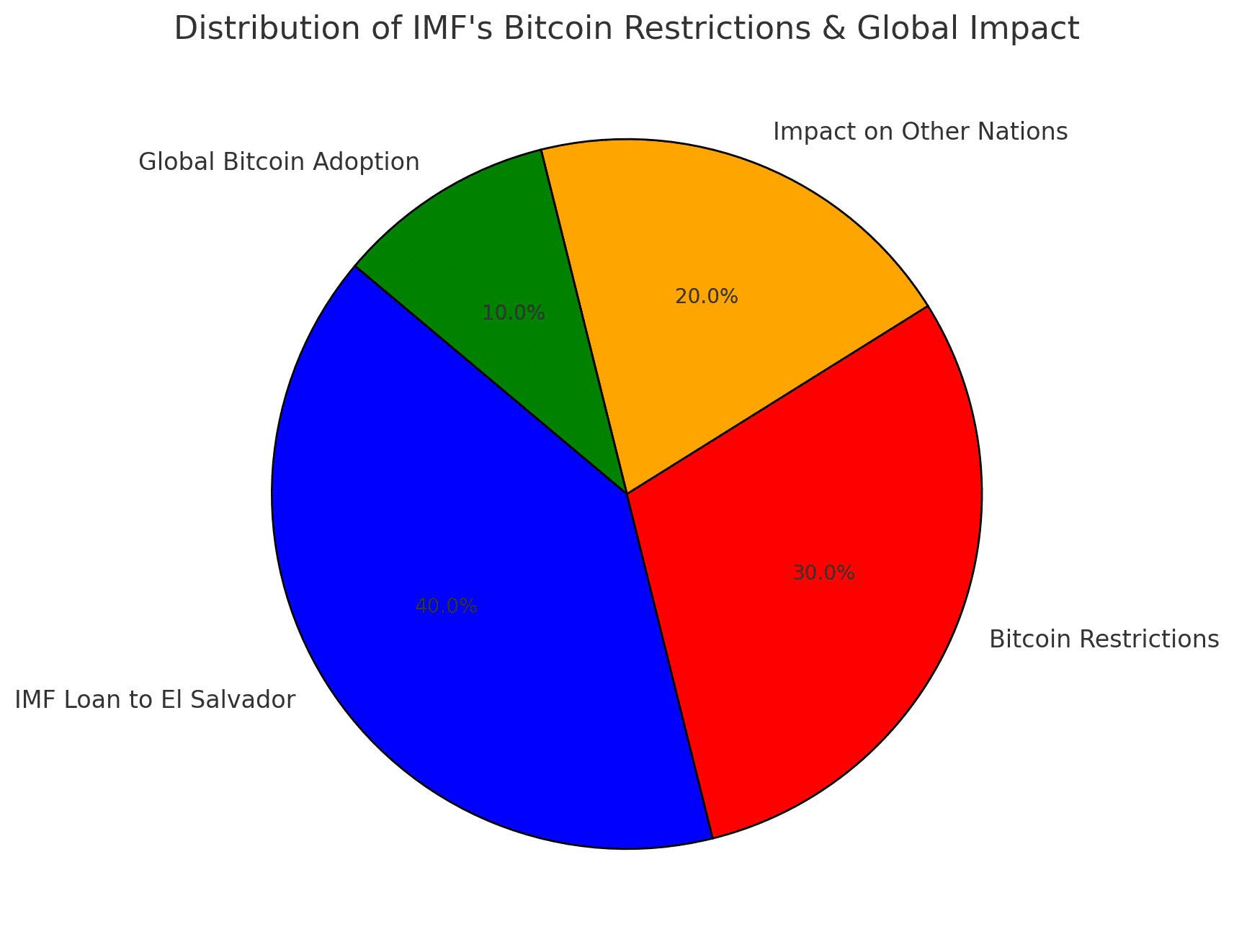

The International Monetary Fund (IMF) has made its stance on Bitcoin clear—if countries want financial aid, they must restrict Bitcoin adoption. This became evident last week when the IMF approved a $1.4 billion deal with El Salvador, reinforcing strict conditions to limit the government’s involvement with Bitcoin.

This move raises concerns about sovereign financial independence and the future of Bitcoin as a legal tender in emerging economies. Will nations comply with the IMF’s restrictions, or will they resist and push for greater crypto adoption?

IMF to Model Bitcoin Policies After El Salvador’s Deal

El Salvador, the first country to adopt Bitcoin as legal tender in 2021, has been in negotiations with the IMF for financial assistance. After months of discussions, the IMF’s executive board approved the agreement, with Deputy Managing Director and Acting Chair Nigel Farage emphasizing the importance of restricting Bitcoin-related activities.

“Program commitments will confine government engagement in Bitcoin-related economic activities, as well as government transactions in and purchases of Bitcoin,” stated Farage.

This effectively means the Bukele administration must scale back Bitcoin purchases in exchange for IMF funding, which will be used to stabilize the country’s economy. While the IMF did not force El Salvador to abandon Bitcoin completely, the deal suggests that any future assistance will come with conditions limiting Bitcoin’s role in state operations.

A Dangerous Precedent for Other Emerging Economies

The IMF’s decision could influence other Bitcoin-friendly nations, especially in Latin America and Africa, where countries are exploring Bitcoin adoption as a means of financial autonomy. Nations looking to embrace Bitcoin as a reserve asset or legal tender may now face pressure from the IMF to choose between economic aid and crypto sovereignty.

For countries struggling with debt or inflation, IMF loans are often a lifeline—but now, they come with strings attached. This deal raises a critical question: Will developing nations sacrifice financial sovereignty for short-term relief?

Bitcoin as a Reserve Asset: A New Economic Framework?

As Bitcoin adoption grows globally, some argue that a crypto-based economic framework should emerge to counter the influence of traditional financial institutions like the IMF.

Former U.S. President Donald Trump recently proposed a strategic crypto reserve, signaling that Bitcoin is gaining recognition as an essential asset. If more countries follow suit, the current financial system—heavily reliant on the U.S. dollar and IMF intervention—could face disruption.

Bitcoin’s core ethos is decentralization and financial independence, which stands in direct opposition to the IMF’s model of centralized economic control. As more nations explore Bitcoin adoption, the creation of a decentralized financial institution could become a necessity to support countries opting out of the fiat-dominated system.

Will More Countries Resist IMF’s Pressure?

El Salvador’s experience with the IMF serves as a blueprint for how other nations might negotiate financial aid while maintaining Bitcoin-friendly policies. Some key factors will determine whether countries comply or resist:

- Economic Stability: Countries with weak economies may have no choice but to accept IMF terms.

- Political Willpower: Governments committed to financial independence may push back against restrictions.

- Alternative Financial Support: If crypto-based financial institutions or independent alliances emerge, countries could reject IMF conditions.

With Bitcoin adoption rising, we could see a divergence in global financial policies, where some nations align with the IMF’s restrictions while others embrace crypto to break free from financial dependencies.

Conclusion

The IMF’s stance on Bitcoin is clear: Want financial aid? Restrict Bitcoin adoption. The El Salvador deal sets a precedent that could shape the future of crypto policies in emerging economies.

As Bitcoin continues to establish itself as a global reserve asset, the battle between traditional financial institutions and decentralized alternatives will intensify. Will nations comply with IMF pressure, or will they seek a new economic path driven by Bitcoin and financial sovereignty?

The coming years will determine whether Bitcoin remains a tool for empowerment or if the IMF and traditional financial institutions succeed in keeping emerging economies within the fiat system’s grip.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. What conditions did the IMF impose on El Salvador regarding Bitcoin?

The IMF’s $1.4 billion deal requires El Salvador to limit government transactions and purchases of Bitcoin, effectively restricting its further adoption at the state level.

2. How does this deal affect other countries considering Bitcoin adoption?

It sets a precedent where IMF assistance may come with conditions that discourage Bitcoin as a legal tender or reserve asset, potentially deterring nations from adopting crypto-friendly policies.

3. Why does the IMF oppose Bitcoin adoption?

The IMF argues that Bitcoin poses financial stability risks, particularly in countries with volatile economies. However, critics believe the opposition is more about maintaining control over global financial systems.

4. Could an alternative financial system emerge to support Bitcoin-friendly nations?

Yes, if more countries adopt Bitcoin and seek financial independence, a crypto-based economic framework could develop, offering an alternative to IMF-backed aid.

5. What’s next for El Salvador’s Bitcoin experiment?

While the country must limit state Bitcoin transactions, private adoption remains unaffected. El Salvador’s success or struggles with Bitcoin will likely influence other nations considering similar policies.

Glossary

- IMF (International Monetary Fund): A global financial institution that provides loans to countries, often with conditions attached.

- Bitcoin as Legal Tender: When a country recognizes Bitcoin as an official currency for transactions.

- Reserve Asset: An asset held by central banks to back national currencies and financial stability.

- Fiat System: A monetary system where government-issued currency is not backed by a physical commodity like gold or Bitcoin.

- Decentralization: The principle of removing control from central authorities, a key feature of Bitcoin and blockchain technology.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)