On Friday, March 7, 2025, President Donald Trump signed an executive order forming a Strategic Bitcoin Reserve, an action that will likely be front and center at the White House Crypto Summit. The implications for the market are substantial, as this program aims to strengthen the U.S. role in the cryptocurrency industry. The summit will also feature a discussion that will bring together key industry leaders, policymakers, and financial experts who will discuss this policy and potential regulatory changes resulting from it.

Volatility in Bitcoin Prices During Economic Policy Announcements

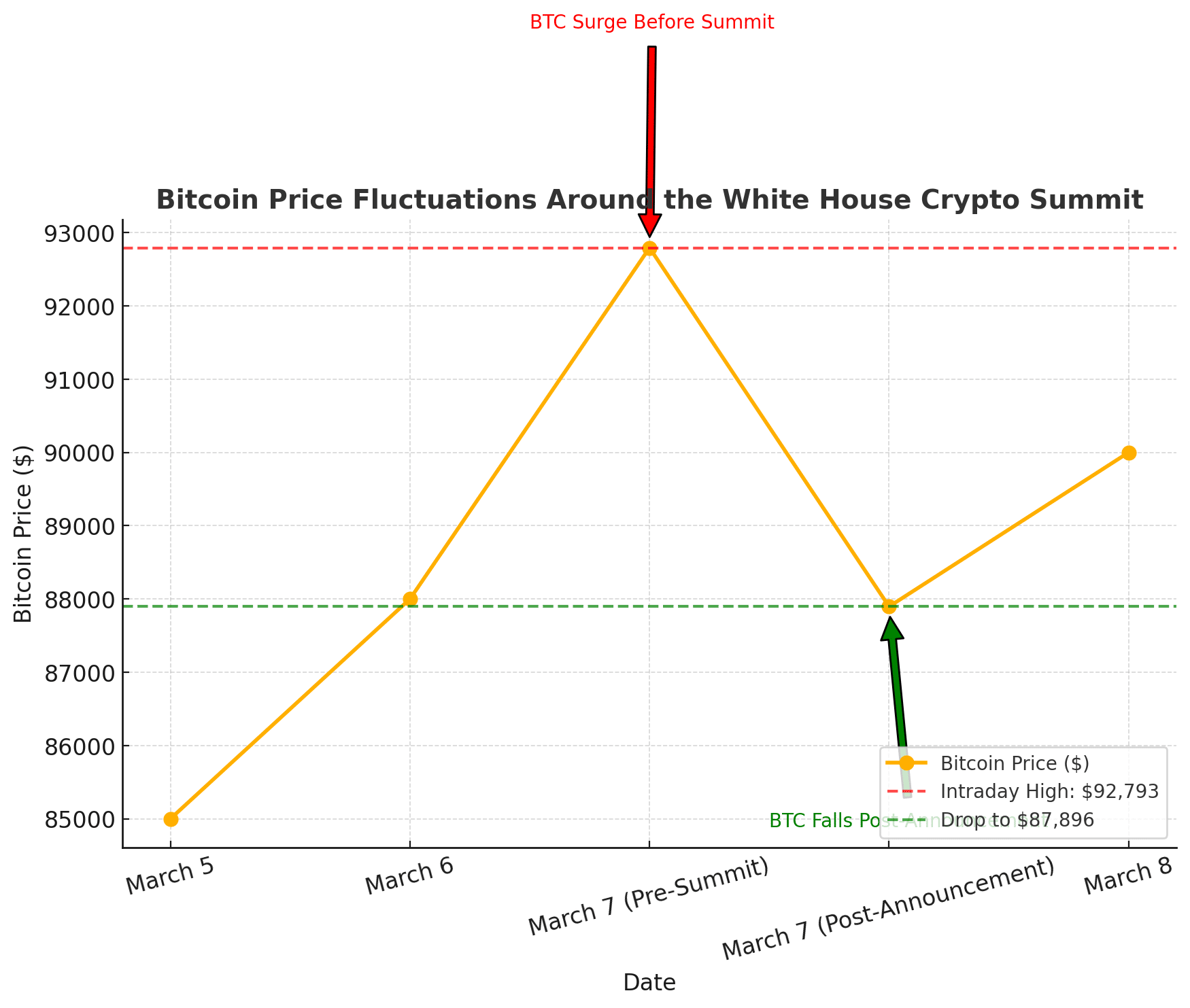

Since the Strategic Bitcoin Reserve was secured, Bitcoin’s price has struggled with wide volatility. It rose as high as $92,793 in the day before slipping back to $87,896, a drop of 4.68% from its peak. Such price action highlights the market’s increased sensitivity to policy developments and rising expectations ahead of the forthcoming White House Crypto Summit. Increased clarity in regulation may lead to institutional participation or create a ripple effect of short-term volatility, according to analysts.

Pro-Crypto Initiatives from This Administration

Howard Lutnick, Commerce Secretary, has noted that Bitcoin will be subject to separate regulatory treatment from other kinds of digital assets, in line with President Trump’s mission to make the U.S. the leader of all cryptocurrency adoption.

“This initiative is in tune with the administration’s vision of making the U.S. a global leader in digital assets,”

Lutnick said. The Strategic Bitcoin Reserve will reportedly include Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), marking a broader approach around major cryptocurrencies.

The Path Forward: Industry Leaders Together

The White House Crypto Summit is expected to feature some major players in the cryptocurrency industry, including:

Michael Saylor, Executive Chairman, MicroStrategy

Brian Armstrong, CEO of Coinbase

Ripple CEO Brad Garlinghouse

These leaders—along with U.S. policymakers and crypto executives—will partake in discussions that could redefine the future of digital asset regulations.

Tax Breaks to Encourage Investment

The reports highlight the possibility of tax incentives being employed, especially capital gains tax cuts for United States-based cryptocurrency projects. These measures could speed up institutional investment and would bolster Bitcoin’s long-term bull case.

Markets React To Economic Uncertainty

General economic indicators have also affected Bitcoin’s price dynamics. The Bank of the Federal Reserve of Atlanta, as of June 4, predicts a 2.8% contraction in GDP for the first quarter, which feeds concerns over economic stability. The long-term outlook for Bitcoin is looking bright; however, economic uncertainty and growing volatility point to potential price swings in the short term.

Technical Analysis: Where Bitcoin Stands Right Now

Bitcoin is currently trading at $87,896 on March 7, 2025, down 4.68% from the highs of the day. This came as the cryptocurrency continued to experience rejection from the level of $92,793, reaffirming the outlook for a short-term downtrend. Should Bitcoin lose support of $84,351, it might drop as low as $81,461 and $78,111. But a bounce above $88,574 can reactivate buying interest, paving the way for a possible retest of the $92,793 resistance hurdle.

Key Insights:

Bitcoin plunged 4.68% to $87,896, with this price action generating a push below the 50-day EMA at $88,574.

A bearish engulfing candle suggests more downside toward $84,351.

A repeat above $88,574 might send BTC back towards challenge at $92,793.

As the White House Crypto Summit gets closer, traders are bracing for increased price volatility if the U.S. Bitcoin reserve strategy is confirmed and leads to an outsized market response.

BTC Bull Token ($BTCBULL) is capturing the attention of many as a community-driven token that rewards holders in actual Bitcoin. Unlike standard meme tokens, BTCBULL automatically airdrops BTC when Bitcoin hits important price milestones, providing powerful incentives for long-term investors.

Earning Passive Income through Staking

BTC Bull belongs with high-yield staking options, enabling users to generate passive income with an astonishing annual percentage yield (APY). During the ICO, users staked a massive amount of Bitcoin tokens as part of this system, with tens of millions of Bitcoin tokens staked.

Current Presale Status:

Presale Price: $0.002395 / BTCBULL

Total Amount Raised: $3.2 million of a $3.66 million goal

As investor demand skyrockets, this presale allows you to pick up BTCBULL at early stage prices before the next price rise.

Conclusion

As the tether of the U.S. dollar continues its descent, the formation of a strategic bitcoin reserve stands to reshape the crypto economy like never before. As the White House Crypto Summit progresses, following potential developments has everybody from crypto financiers to regulatory agencies ears to the ground as market dynamics and regulatory frameworks covering the digital asset space begin to take form.

Note that this is only intended for educational purposes and does not constitute investment advice. Disclaimer: This article is for informational purposes only and should not be considered financial advice. Research your investments thoroughly before making any decisions.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

Frequently asked questions

1. What is the Strategic Bitcoin Reserve? Why it Matters

Whether or not it’s you, the U.S. Strategic Bitcoin Reserve is shaking up Bitcoin at the national level, with implications for financial monopoly and institutional confidence as well.

2. What does Trump’s Bitcoin plan mean for the crypto market?

Should this be adopted, institutional adoption likely increases further and prices soar. But regulatory ambiguity could lead to volatility that may impact investor sentiment and stability in the marketplace.

3. What other cryptocurrencies, apart from Bitcoin, can be used in the reserve?

ETH, along with XRP, Solana (SOL), and Cardano (ADA), are reportedly on the list, expanding the government’s digital asset framework beyond Bitcoin.

4. How does this program impact Bitcoin price action?

Bitcoin spiked to $92,793, falling back to $87,896, a reflection of market sensitivity. The clarity of future policy may continue to fuel future long-term bullish momentum or volatility in the short term.

Glossary of Key Terms`

Bitcoin National Stockpile: A potentially shoaled city government holding BTC as a form of pressure on crypto market momentum and influence across the globe.

White House Crypto Summit: An event with contributions from policymakers discussing regulation, digital assets and the growing calls for a U.S. Bitcoin reserve.

Bitcoin Volatility: A sudden and considerable change to the price of Bitcoin, often the results of market speculation, the regulatory framework, and the institutional adoption.

Institutional Investment: The increased future growth of liquidity in Bitcoin and other cryptos, with large immortal investments made from hedge/good funds, corporations, or different governments.

Capital Gains Tax on Crypto: The tax applied to profits from selling cryptocurrency, which the Trump administration is reportedly floating a reduction or elimination of, but applied to U.S. projects.

Market Psychology: The collective feeling that investors are having towards Bitcoin and cryptocurrencies based on news and policies as well as economic indicators influencing buying and selling.

Support and Resistance Levels: Key price points in Bitcoin trading where buying pressure (support) or selling pressure (resistance) stops any further price movement.

Regulatory Framework: The government policies and legal structures that govern the cryptocurrency industry, impacting adoption, security, and financial stability in the realm of digital assets.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)