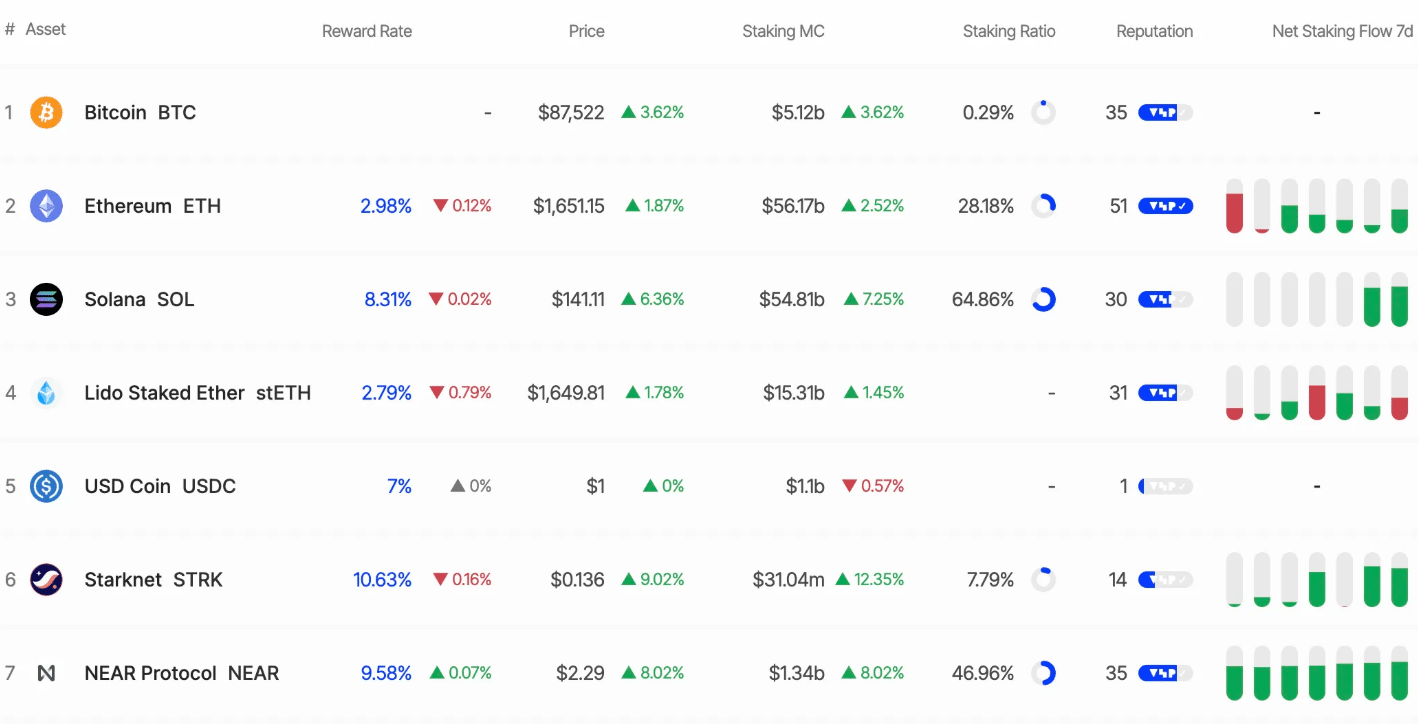

Solana (SOL) has made headlines recently by surpassing Ethereum (ETH) in staking market capitalization, reaching an impressive $53.96 billion, compared to Ethereum’s $53.77 billion. This milestone has sparked a wave of excitement and debate in the cryptocurrency community. While some view it as a sign of SOL growing dominance, others question whether this surge is sustainable or just a short-term trend.

Solana’s Staking Dominance

Solana’s ascent in the staking market has been fueled by the fact that 64.86% of its total supply is currently staked, offering an attractive annual percentage yield (APY) of 8.31%. In comparison, Ethereum has only 28.18% of its total supply staked, providing a more modest APY of 2.98%. The high percentage of SOL supply locked in staking highlights the increasing interest from investors looking for passive income, which has been one of Solana’s key selling points.

Staking market capitalization is calculated by multiplying the total number of staked tokens by their current price. With Solana’s price at $138.91, it has officially surpassed Ethereum in terms of this metric, marking a significant achievement for the blockchain. This growing appeal is reflective of Solana’s competitive advantages, including its higher staking rewards and efficient network performance.

Criticism of Solana’s Staking Model

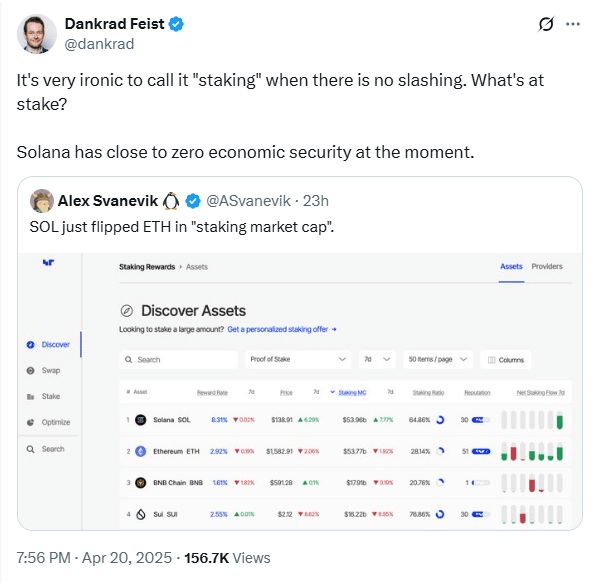

Despite the impressive staking ratio, Solana’s model has come under scrutiny from some critics. One key concern raised by blockchain expert Dankrad Feist on X is SOL lack of a slashing mechanism. In the absence of penalties for validator violations, critics argue that Solana’s staking system may not offer the same level of security as Ethereum’s, which uses slashing to ensure validators act honestly. Without this mechanism, some question the long-term security and reliability of SOL network.

While SOL staking rewards attract investors, it’s important to consider the risks that come with a less secure staking model. As Ethereum has proven, slashing can be an important feature for maintaining the integrity of the network, even if it means lower staking ratios.

Source: Dankrad Feist

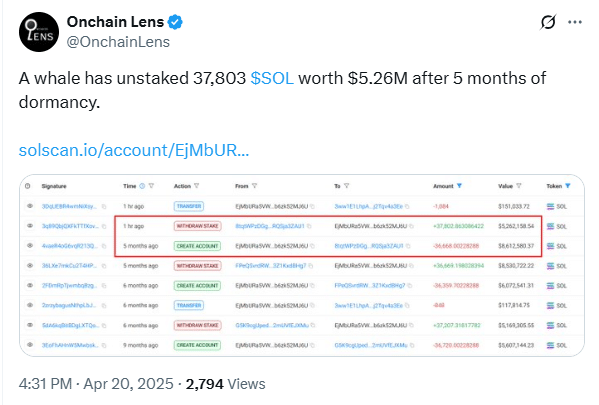

Whale Movements: Institutional Interest in Solana

In recent weeks, SOL has seen significant movements from large investors, also known as “whales.” On April 20, 2025, a whale unstaked 37,803 SOL, worth $5.26 million, while Galaxy Digital withdrew 606,000 SOL from exchanges between April 15 and 19, 2025. Additionally, Binance whales removed over 370,000 SOL tokens, valued at approximately $52.78 million.

These withdrawals have caused some concern in the market, as they suggest that large investors may be cautious about SOL price stability. However, not all institutional players are pulling back.

Janover, a US-listed company, increased its Solana holdings by 163,651.7 SOL, worth $21.2 million, and partnered with Kraken Exchange for staking on April 16, 2025. These moves indicate that some institutional investors remain confident in Solana’s future despite recent fluctuations.

SOL Price Movement and Technical Levels

At the time of writing, Solana is trading at $139.16, up by 2.14% in the past 24 hours. Analysts have identified key technical levels that could shape SOL price action in the coming weeks. The $129 level is seen as critical support, while the $144 level is viewed as a significant resistance point. If Solana can break above $144, it may pave the way for further price increases, with some analysts predicting a potential rally towards new highs.

On the other hand, if SOL price falls below the $129 support, it could signal a bearish trend and lead to increased selling pressure. Despite these risks, SOL has shown strong resilience, with a remarkable 14.34% increase in price over the past week.

Solana’s Ecosystem Growth and Innovation

Solana’s growth is not just driven by staking; the blockchain is also focused on enhancing its ecosystem through key innovations. The QUIC data transfer protocol and the combination of Proof-of-History (PoH) and Proof-of-Stake (PoS) are improving the blockchain’s scalability and decentralization. These innovations have made SOL a popular choice for developers looking for high-performance blockchain solutions.

The launch of the Solang compiler, which is compatible with Ethereum’s Solidity, has attracted developers from the Ethereum ecosystem, signaling Solana’s increasing appeal. This continued focus on performance and developer adoption is positioning SOL as a strong contender in the blockchain space.

SOL Breakpoint: The Community Event

SOL upcoming community conference, SOL Breakpoint, is generating excitement within the crypto community. The event, scheduled for later this year, is expected to feature key announcements that could further propel Solana’s growth. As the conference approaches, the anticipation of new partnerships, technological advancements, and ecosystem developments is high.

Conclusion

While SOL has made impressive strides in staking market capitalization and continues to innovate, it faces significant challenges. Ethereum’s more established DeFi ecosystem, higher institutional trust, and slashing mechanism provide a robust foundation that Solana is still working to match.

Furthermore, Solana’s high staking ratio, while attractive to investors seeking passive income, may limit liquidity in its DeFi ecosystem.

The key question for SOL is whether it can strike a balance between its staking incentives and the liquidity needs of decentralized applications. As the blockchain continues to grow and evolve, Solana’s ability to maintain a strong staking model while fostering liquidity in its ecosystem will be critical to its long-term success.

Frequently Asked Questions (FAQs)

1- What makes Solana’s staking model stand out from Ethereum’s?

Solana offers a higher staking ratio and annual percentage yield (APY) compared to Ethereum.

2- Why do some investors worry about Solana’s staking security?

Solana lacks a slashing mechanism, which could affect the network’s long-term security.

3- How much SOL is currently staked in total?

Approximately 64.86% of SOL total supply is staked, offering high yields for investors.

4- What role do institutional investors play in SOL’s growth?

Large institutional investors, such as Janover, continue to increase their SOL holdings, signaling confidence.

Appendix Glossary of Key Terms

Staking – The process of locking up cryptocurrency to support network operations in exchange for rewards.

Annual Percentage Yield (APY) – The annual return on an investment, accounting for compound interest.

Slashing Mechanism – A penalty system that reduces rewards or removes staked tokens for validator misconduct.

Whales – Large investors or entities holding significant amounts of cryptocurrency, often capable of impacting the market.

Staking Market Capitalization – The total value of staked tokens, calculated by multiplying the staked amount by the current token price.

Proof-of-History (PoH) – A consensus mechanism used by Solana to timestamp transactions, enhancing network efficiency.

Proof-of-Stake (PoS) – A consensus algorithm where validators are chosen to create new blocks based on the amount of cryptocurrency staked.

Reference

Coinomedia – coinomedia.com

BeInCrypto – beincrypto.com

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)