US Bitcoin ETFs have attracted over $2 billion in inflows since early July. The past week alone saw more than $1 billion flowing into these funds, marking the third consecutive week of net inflows. This surge has not only broken records but also set new milestones, reflecting a growing investor confidence in the cryptocurrency market.

The Surge in Inflows

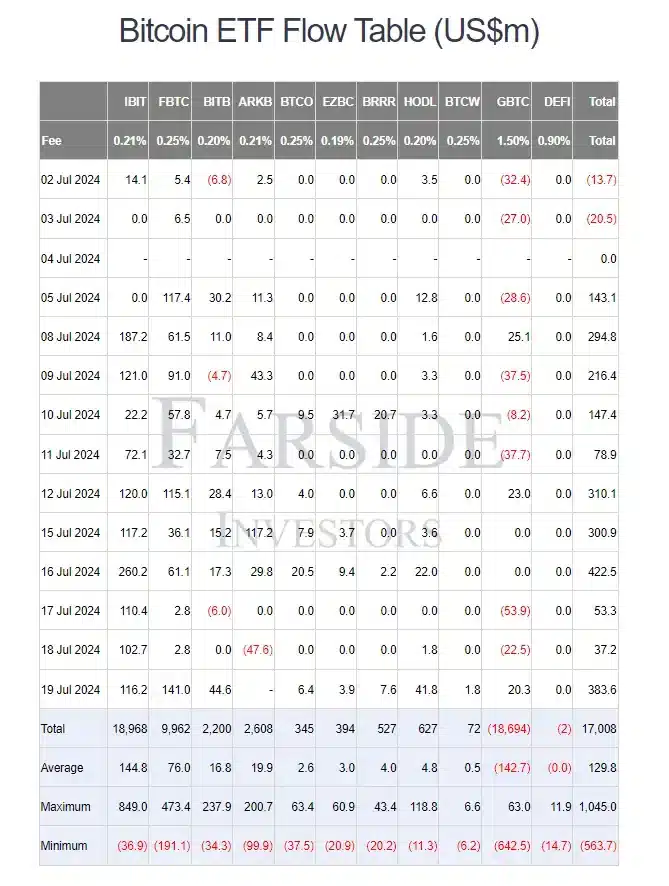

According to market data from Farside Investors, US Bitcoin ETFs have been on an impressive run. These ETFs recorded inflows above $300 million thrice this week, with a record single-day inflow of $422.5 million on July 16. This influx is the highest in the past six weeks, showcasing the rising interest in Bitcoin investments.

Record-Breaking Inflows: US Bitcoin ETFs Draws $2 Billion, Surpasses 900k In BTC Holdings

These ETFs have now reached a new milestone, with $17 billion in net flows over six months. This figure surpasses Bloomberg analysts’ estimates of $15 billion over 12 months, highlighting the robust demand. Shubh Varma, Co-Founder and CEO of Hyblock Capital, emphasised the significance of these numbers in an interview with BeInCrypto. He noted that the inflows indicate strong market demand and a renewed surge in investor interest.

The Impact of Recent Inflows

Varma elaborated on the impact of these inflows: “Interestingly, most of these inflows occurred within the last 30 days, signalling a recent surge in investor interest. This demonstrates growing investor confidence and participation, which can boost prices and market capitalization, promoting overall market growth.”

This remarkable influx has pushed the total number of BTC held by US Bitcoin ETFs to a record of over 900,000 BTC, valued at more than $60 billion. Nate Geraci, President of the ETF Store, reported that these holdings represent 4.3% of BTC’s total supply.

Leading the Pack: Top US Bitcoin ETFs

A breakdown of the holdings revealed some interesting insights. BlackRock’s IBIT holds the most Bitcoin among US Bitcoin ETFs, with 327,182 BTC valued at $21.79 billion. This is followed by Grayscale’s GBTC, with 272,193 BTC worth $18.1 billion, and Fidelity’s FBTC, which completes the top three with over 180,000 BTC valued at $12 billion.

These figures underscore the significant role these ETFs play in the Bitcoin market and highlight the level of trust and interest from investors. As more funds flow into these ETFs, the market dynamics are likely to shift, potentially impacting Bitcoin prices and overall market trends.

What This Means for the Future

The strong performance of US Bitcoin ETFs points to a growing acceptance of Bitcoin as a legitimate investment vehicle. Investors are increasingly looking to these ETFs as a way to gain exposure to Bitcoin without directly purchasing the cryptocurrency. This trend is likely to continue as more investors seek to diversify their portfolios with digital assets.

Moreover, the success of these ETFs could pave the way for new products and innovations in the cryptocurrency market. As demand for Bitcoin ETFs grows, we may see more funds launched, offering different investment strategies and risk profiles. This could further enhance Bitcoin’s accessibility and appeal to a broader range of investors.

Investor Confidence and Market Growth

The recent surge in inflows into US Bitcoin ETFs signals a renewed investor confidence in the cryptocurrency market. This confidence is crucial for the long-term growth and stability of the market. As more investors enter the market through these ETFs, we can expect to see increased liquidity and market depth.

In the words of Shubh Varma, “This demonstrates growing investor confidence and participation, which can boost prices and market capitalization, promoting overall market growth.” His insights highlight the potential for these inflows to drive further growth and development in the cryptocurrency market.

The Final Word

The record-breaking inflows into US Bitcoin ETFs are a testament to the growing interest and confidence in Bitcoin as an investment. With over $2 billion in inflows since early July and a total of $17 billion in net flows over six months, these ETFs are significantly impacting the market. As more investors turn to these funds, the future looks bright for Bitcoin and the broader cryptocurrency market. The success of these ETFs not only reflects the current market dynamics but sets the stage for continued growth and innovation in the digital asset space. Stay on TurkishNY Radio for more.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)