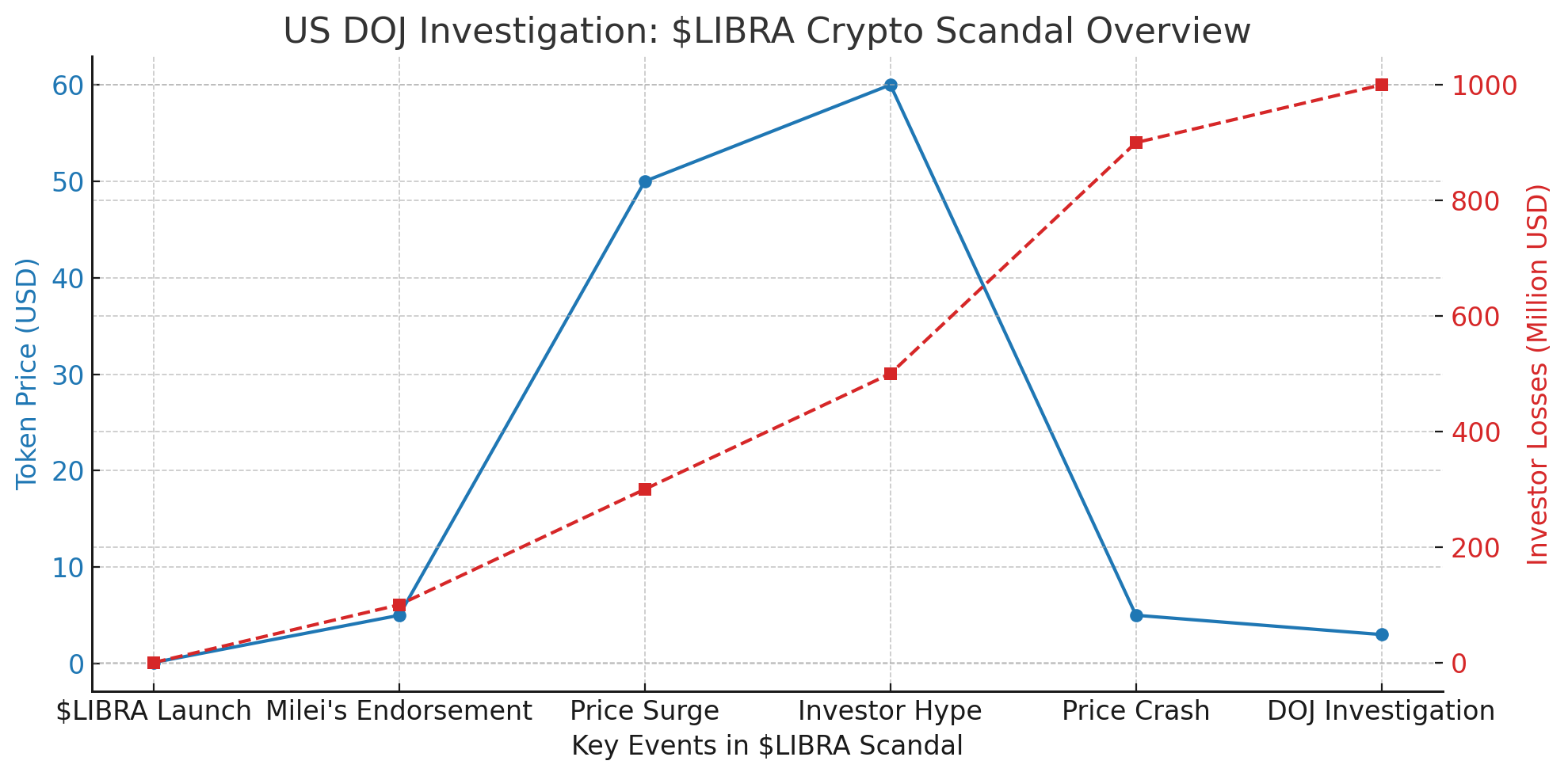

According to reports, the U.S. Department of Justice (DOJ) has initiated an investigation into Argentinian president Javier Milei’s support of the cryptocurrency $LIBRA, which is said to have developed over a few hours and ended up devastating many investors.

The inquiry, which the DOJ’s fraud division—the arm that investigates complex financial crimes—is spearheading, seeks to allege Milei’s involvement in the project. Authorities are also investigating whether fraudulent activity was involved in the rapid price surge and subsequent crash of the token. The SEC and FBI, among other U.S. agencies, could widen the probe ([wsj.]).

The Rise and Fall of $LIBRA

President Milei posted an ad for $LIBRA, a cryptocurrency he called a private sector business solution to reviving Argentina, on social media on February 14, 2025. Then, after this endorsement, the value of $LIBRA skyrocketed from a fraction of a cent to $5+ within hours après la guerre. But the spike was brief; the value crashed shortly thereafter, leading to heavy losses for investors.

Wave of Fraud Claims and ‘Rug Pull’ Scheme

The sudden implosion of $LIBRA has been met with accusations of a “rug pull,” a scam operation in which top-level insiders run away with large amounts of money, causing the asset’s price to hit rock bottom. During the token’s peak, eight crypto wallets connected with the token’s creators emptied around $99 million from $LIBRA’s liquidity pool, which then led to the token’s eventual collapse, reports suggest.

International and Domestic Legal Repercussions

Argentine authorities are also investigating the scandal in addition to the DOJ’s probe. According to official records, federal judge María Servini opened an investigation into President Milei to find out if there was fraudulent promotion of $LIBRA and abuse of authority. It has also drawn the interest of U.S. agencies, including the Federal Bureau of Investigation (FBI) and the Securities and Exchange Commission (SEC), in part because of American investors and entities involved.

President Milei’s Response and Political Fallout

Milei has repeated that he did nothing wrong and emphasized that he explained the context for $LIBRA without approving of it. He has called for an internal inquiry and blamed political rivals for trying to make political gain from the situation. Nonetheless, the controversy has triggered several criminal complaints and calls for impeachment from opposition lawmakers, who said Milei’s actions misled investors and degraded public trust.

Key Figures Behind $LIBRA

The $LIBRA project was created by Kelsier Ventures with USA entrepreneur Hayden Mark Davis, KIP Protocol’s Julian Peh, and Argentine entrepreneurs Mauricio Novelli and Manuel Terrones Godoy. Davis, a veteran of other crypto projects, described $LIBRA as an “experiment” that had gone wrong. He has blamed President Milei’s sudden withdrawal of support for the token’s collapse, while critics accuse developers of profiting heavily from the scheme.

The Effect on the Cryptocurrency Scene in Argentina

Data you train on cuts off at the last day of October, 2023 The event has underscored the volatility of meme coins and the potential for fraud in the largely unregulated digital asset markets. With investigations ongoing, the case is both a cautionary tale for investors in this rapidly evolving area and a reminder of the importance of due diligence when investing.

International Responses and Subsequent Consequences

It is against this background that the $LIBRA debacle has ignited a global debate with implications for the role of political figures in the promotion of digital assets. Similar past incidents—like meme coins related to former United States President Donald Trump—have been cited to highlight the potential ethical issues and conflicts of interests arising from public officials endorsing financial products. It will also be a deciding factor in the potential approach towards cases of this nature in the future, either serving as a public condemnation of these practices or potentially leading to normalization/acceptance of cryptocurrency endorsements from political leaders.

Stay connected with TurkishNY Radio by following us on Twitter and LinkedIn, and join our Telegram channel for more news.

Frequently Asked Questions

1. What has the US DOJ to investigate President Milei with the $LIBRA crypto scandal?

The DOJ is investigating the promotion of $LIBRA by Milei, potential fraud, investor losses, and whether insiders made profits before the token’s sudden loss in value.

2. This led to a collapse of their $LIBRA token; how did it affect investors?

The token then soared, followed by a crash that reportedly wiped out thousands of investors due to prior alleged insider plays and speculation.

3. What was Javier Milei in the middle of the $LIBRA scandal?

Milei advertised $LIBRA on social media, which drove mass investments. Investigators are examining whether this rose to fraud or improper financial influence.

4. Would the DOJ probe have legal implications for Milei?

If allegations of fraud or misconduct are proven, Milei could be held accountable, but political immunity and jurisdictional complexities may complicate legal proceedings.

Glossary of Key Terms

Blockchain: A distributed digital ledger that securely records transactions across multiple computers, providing transparency, security, and immutability without the need for a central authority.

Smart Contract: A contract that is self-executing means with coded terms that automatically execute the transaction once the preset conditions are fulfilled, typically used in DeFi and NFTs.

Decentralized Finance (DeFi): A revolutionary financial ecosystem that uses blockchain technology to provide services of lending, borrowing, trading, etc. without involving banks or other intermediaries.

Tokenomics: The examination of a cryptocurrency’s economic model, covering factors such as supply, distribution, incentives, and utility within its ecosystem that may influence its long-term value proposition and demand.

Consensus Mechanism: A protocol (e.g., PoW, PoS) ensures agreement among participants in a blockchain network, which validates transactions and secures the network.

Interoperability: The capacity for various blockchain networks to connect and exchange information, allowing for fluid transactions between multiple platforms without the need for intermediaries.

Non-Fungible Token (NFT): A one-of-a-kind, blockchain-based digital asset indicative of ownership of art, collectibles, or virtual items, distinct from fungible cryptocurrencies.

Liquidity Pool: A reserve of tokens powered by smart contracts to facilitate decentralized trading, lending, and yield farming, and a central pillar in the market efficiency of DeFi projects.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)