DeFi Education Fund Asks White House Crypto Chief David Sacks to Stop DOJ Prosecution of Tornado Cash Founder The leading cryptocurrency lobbying organization, DeFi Education Fund (DEF), on Wednesday submitted a formal appeal to White House crypto czar David Sacks to weigh in on the Department of Justice’s (DOJ) criminal lawsuit against Tornado Cash co-founder Roman Storm.

In a letter sent April 28, DEF slammed what it called the criminalization of open-source software development and called on the president to take quick action.

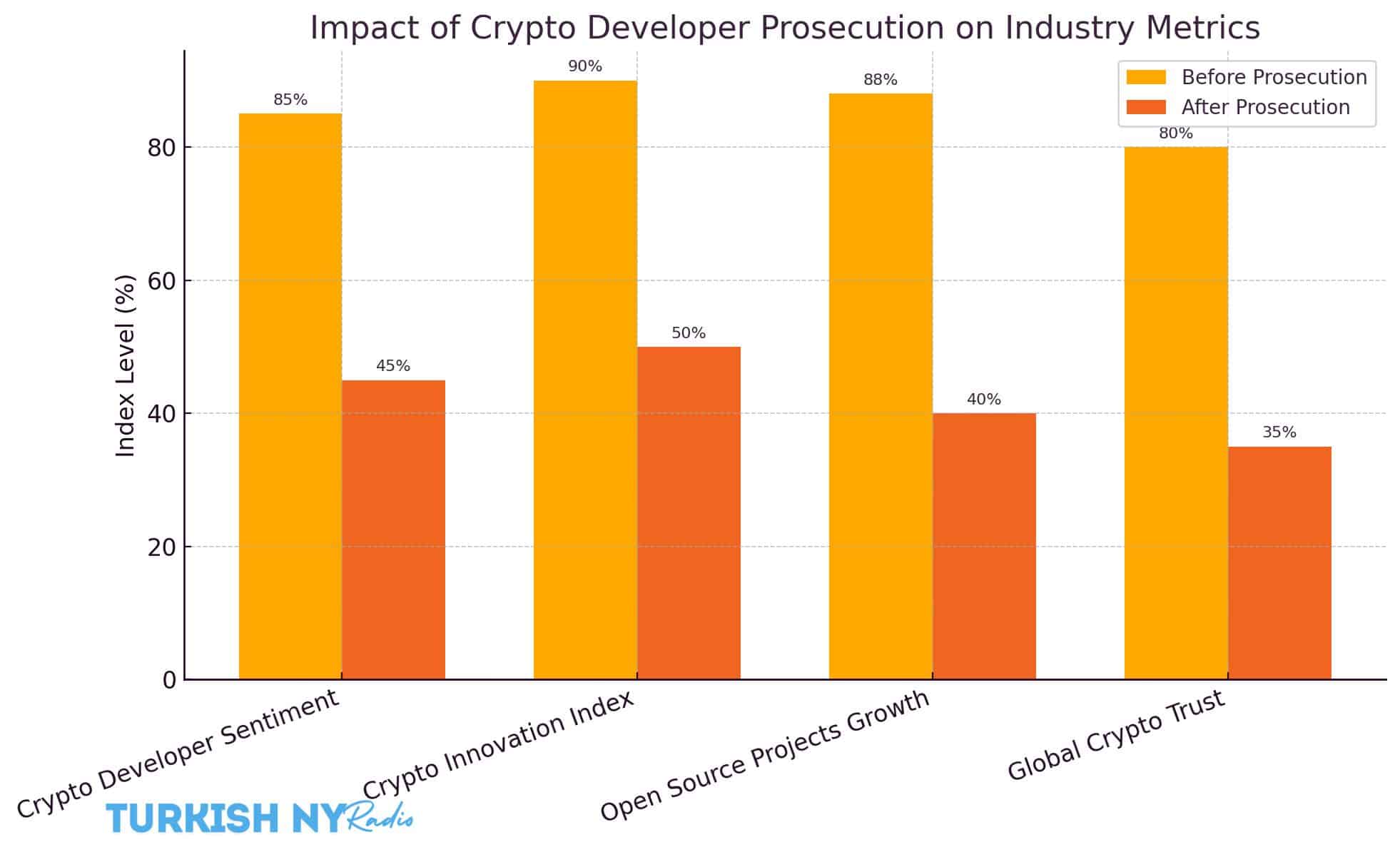

The group’s letter emphasized that outdated analyses of technology and law drive Storm’s ongoing battle with the courts. DEF argued that if this prosecution continues, it could provide a possible precedent for a chilling effect on the full software development community.

“This prosecution is a dampener on innovation for all industries, not just crypto,”

The DEF letter was contested.

Background: Roman Storm (and the Tornado Cash Incident)

Roman Storm, a co-creator of the Tornado Cash decentralized cryptocurrency mixing service, was charged in August 2023 for his alleged involvement in more than $1 billion worth of crypto laundering. His case is due to be heard in July 2025, and co-founder Roman Semenov is believed to be on the run and is thought to be in Russian authorities.

The DeFi Education Fund argues the DOJ case is fatally flawed, trying to blame developers for misuse of their code by others. DEF noted that this interpretation directly contradicts guidance from the Financial Crimes Enforcement Network (FinCEN) in the first term of the Donald Trump presidency, which made clear that non-custodial-software developers are not deemed money transmitters.

An unrelated legal development bolsters DEF’s contention: In January 2025, a federal court in Texas found that the Treasury Department exceeded its authority in sanctioning Tornado Cash.

Leaders of the Trade Express Support for Roman Storm

The petition to David Sacks has received considerable support from the industry, with the backing of figures including the co-founder of Coinbase, Fred Ehrsam; the co-founder of Paradigm, Matt Huang; and the Ethereum core developer, Tim Beiko.

Jake Chervinsky, the chief legal officer of Variant Fund, similarly criticized the prosecution as

“an old-school vestige of the Biden administration’s war on crypto.”

Chervinsky further noted:

“Under the law, and also under policy, there is no reason to go after developers for turning out non-custodial smart contract systems.”

A group called the DeFi Education Fund cautioned that if prosecutors are not stopped, “it will do unimaginable harm” to innovation, investment, and technological infrastructure in the United States.

Read full article Tornado Cash (TORN) Price Update and Analysis The price of Tornado Cash (TORN), a privacy-oriented cryptocurrency, has been decreasing since reaching an all-time high on Feb.

The protocol’s native currency, TORN, is trading at $2.18 on April 29, 2025, marking a negligible 1.7% rise in the past 24 hours on CoinMarketCap.

Tornado Cash (TORN) Price Prediction

| Timeframe | Target Price (USD) | Analysis Basis |

| Q2 2025 | $2.50–$3.00 | Legal outcomes, political support |

| Q4 2025 | $3.80–$4.20 | Market recovery, DeFi sector expansion |

| Q2 2026 | $5.00+ | Adoption of privacy-focused crypto tools |

More Signposts for U.S. Crypto Policy

You know, if we’re going to get there, if we’re going to be putting America at the forefront of crypto in the world, of these promising technologies, it’s not going to be while our developers are being carted off to jail.

The group’s petition argued that the protection of developers is crucial to preserving America’s edge in the blockchain space and financial innovation. Without proper legal precedents, progress in decentralized finance (DeFi) may stall and see talent and capital flow to more regulatory-friendly zones.

According to Derypt, cryptocurrency policy is emerging as a major talking point in the US presidential race in 2024. The Biden administration’s more stringent approach to regulation is in stark contrast to Trump’s campaign, which has grown increasingly friendly to digital assets.

A Make or Break Moment for the Crypto Industry

The case of Roman Storm could determine the future of cryptocurrency and open-source development in the United States. An end to the prosecution could spur new faith among developers and investors. On the other hand, a conviction may set a precedent that flies in the face of the core values of decentralized innovation.

With the fireworks on display in court, shareholders in the digital asset space are watching intently to see what the next pieces of the puzzle from both the courts and the White House might be.

Keep following us on Twitter and LinkedIn, and join our Telegram channel for more news.

FAQs

1. Why is the Justice Department prosecuting Roman Storm?

Roman Storm is accused of making it possible for $1 billion to be laundered in cryptocurrency using Tornado Cash, a decentralized privacy protocol, even though the suspect didn’t transact directly.

2. What are the big questions that the crypto industry has about this prosecution?

The industry is afraid the case could make redeeming cryptocurrency even riskier for the masses, criminalize open-source development, and set a reckless legal precedent that could apply to anyone writing blockchain software.

3. How does the DeFi Education Fund explain the decision to support Tornado Cash creators?

DEF contends that holding developers liable for the actions of others would contradict guidance from FinCEN and could stultify software development across the crypto and tech ecosystems.

4. What could this case mean for the American crypto industry?

If upheld, it could push talent overseas, damage investor confidence, and prevent the U.S. from continuing to lead the world in blockchain innovation and financial technology.

Glossary of Key Terms

1. Tornado Cash

Decentralized Crypto Mixer protocol to enhance transaction privacy in blockchains such as Ethereum by breaking the on-chain link between source and destination addresses in digital asset transfers.

2. Roman Storm

Software developer and co-founder of Tornado Cash, who is charged with U.S. federal charges of having enabled cryptocurrency money laundering using the decentralized privacy platform.

3. DeFi Education Fund (DEF)

A not-for-profit advocacy organization committed to ensuring clarity in policy through DeFi projects to support and defend innovation within open-source blockchain development.

4. Platform for Open-Source Development

Open-source software development, where anyone can use, modify, and distribute the source code, is frequently utilized in blockchain ecosystems.

5. Department of Justice (DOJ)

The U.S. federal law enforcement agency, which prosecutes cryptocurrency-related crimes and issues financial compliance regulations.

6. Financial Crime Enforcement Network (FinCEN)

A bureau of the U.S. Treasury Department that fights money laundering and financial crime offers regulatory guidance for cryptocurrency businesses and blockchain developers.

7. Crypto Developer Liability

The legal precedent that could dictate that developers are liable for how their decentralized applications are used or misused—a massive risk to blockchain progress.

8. Crypto Regulation

The set of laws, rules, and regulations developed by governments to control cryptocurrency transactions, trading, privacy, and contract compliance in fintech infrastructures.

![BitTorrent [New]](https://s2.coinmarketcap.com/static/img/coins/64x64/16086.png)